What is a Contract Management Software (CMS)?

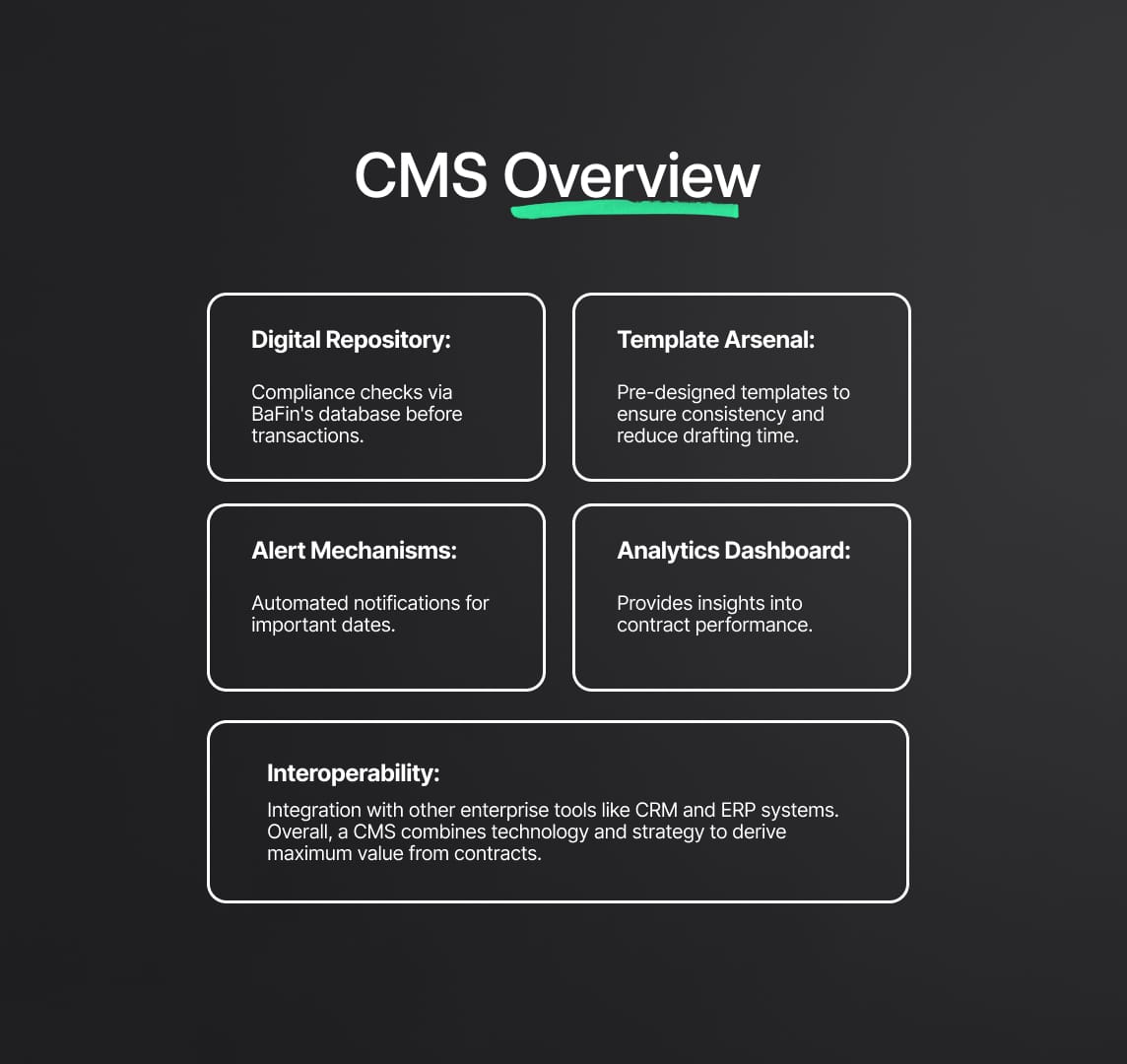

Our conversation centered on the intricacies of contract management systems, emphasizing their pivotal role in modern business. We detailed their primary functions, such as central storage and data analytics, and underscored the numerous operational benefits they offer.

Why Contract Management Software Is Mission-Critical

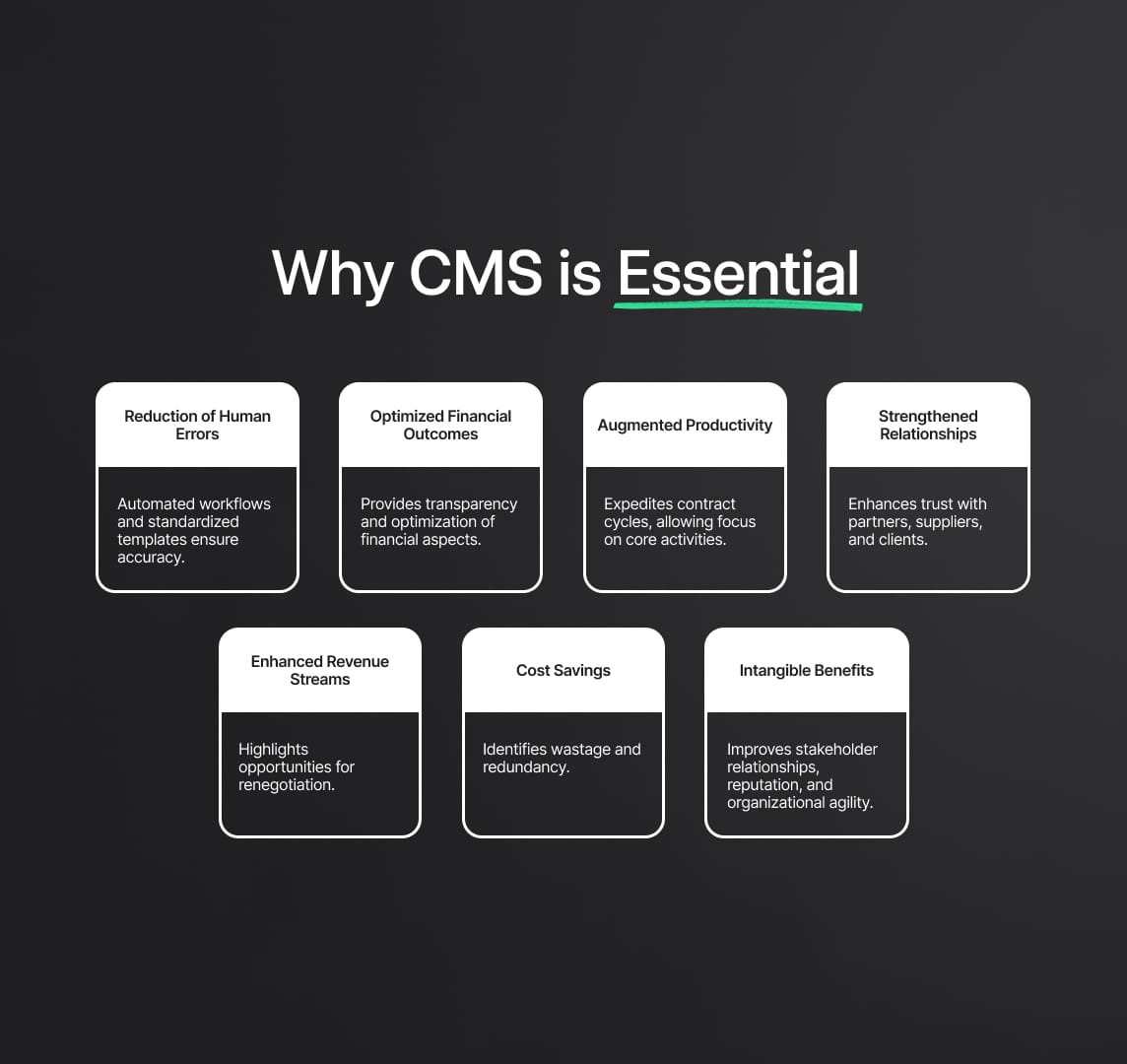

In today’s financial services landscape, a Contract Management System (CMS), also called contract management software or a Contract Lifecycle Management (CLM) solution, is no longer a “nice-to-have.” By digitising and governing every phase of the contract lifecycle, a CMS elevates contract handling from clerical duty to strategic function. The stakes are high: World Commerce & Contracting reports that ineffective contract practices drain an average 9 % of annual revenue. For legal, risk and compliance teams, an enterprise-grade CMS safeguards regulatory compliance, accelerates workflows, and delivers audit-ready transparency.

What a CMS Delivers to Finance Professionals

A contract management system is a secure, centralised platform that creates, negotiates, approves, executes and monitors contracts at scale. Financial institutions rely on it to manage high-volume, high-value agreements, from vendor contracts and client service agreements to trading documentation and NDAs, under stringent regulations. Core capabilities include:

- Unified contract repository with role-based access

- Automated workflows for review, approval and renewal

- AI-driven clause extraction and risk scoring that flag deviations in real time

- Version control and full audit trails for evidentiary compliance

- Advanced search and reporting that surface obligations, risks and untapped value

Gartner now classifies contract management software as a “core enterprise system” for governing costs, revenue and risk, no longer a simple date-tracking tool. In practice, a CMS becomes the single source of truth: stakeholders can instantly verify what was signed, by whom, when and under which terms, replacing siloed spreadsheets with real-time certainty.

Why Finance Firms Need Contract Management Software

Financial services operate in one of the world’s most regulated arenas. Frameworks such as SOX, MiFID II, Dodd-Frank and GDPR demand meticulous oversight of agreements with customers, vendors and counterparties. Mismanaging a contract, allowing a critical clause to lapse or using unapproved language, can trigger fines, reputational damage and operational loss. A robust CMS prevents these pitfalls by enforcing standard language, approval hierarchies and obligation monitoring.

The operational upside is equally compelling. Internal studies at Goldman Sachs indicate that automating contract management can:

- Cut negotiation cycle time by up to 50 %

- Reduce erroneous payments by 75–90 %

- Lower overall contract-administration costs by 10–30 %

Beyond cost control, finance leaders unlock hidden value: identifying revenue in overlooked auto-renewals, consolidating vendor spend, and extracting market insights sealed inside contractual data. In short, a Contract Management System secures compliance, mitigates risk and transforms the contract portfolio into a lever for growth.

Regulatory Compliance in Financial-Services Contracts, How Contract Management Software Keeps You Audit-Ready

Financial institutions navigate a labyrinth of regulations, each dictating how contracts are created, stored and enforced. A Contract Management System (CMS) provides the controls, traceability and transparency regulators demand while reducing manual overhead. Below is a regulation-by-regulation look at how an enterprise-grade CMS satisfies the most stringent rules without sacrificing speed or strategic insight.

Sarbanes–Oxley Act (SOX): Five-Year Retention With Immutable Audit Trails

- What SOX Requires

- Section 802 obliges publicly traded firms to preserve all business records—electronic messages included—for at least five years.

- Non-compliance exposes executives to severe fines and even imprisonment.

- How a CMS Delivers Compliance

- Automated retention policies lock every executed agreement, amendment and negotiation thread for the mandated duration.

- Immutable audit trails log each edit, approval and signature, providing defensible evidence for internal-control attestations.

- Central archiving replaces scattered file shares, ensuring no contract or approval slips through undocumented—critical for financial-reporting integrity.

Dodd–Frank: Complete Transparency for Derivatives and Swaps

- What Dodd–Frank Demands

- Full, searchable records of swaps, derivatives and related communications for oversight bodies such as the CFTC and SEC.

- How a CMS Enables Oversight

- Central repository stores master agreements (e.g., ISDAs) alongside every confirmation and amendment.

- Metadata tagging (product type, counterparty, trade date) speeds retrieval during regulatory inquiries—documents surface in minutes, not days.

- System integrations with trading and communications archives ensure contracts, chats and emails are cross-referenced and preserved as a single evidentiary package.

MiFID II: Seven-Year Capture of All Transaction Communications

- Regulatory Scope

- EU firms must record all communications that lead to a transaction—emails, calls, social media, face-to-face meetings—for up to seven years.

- CMS Contribution

- Version-controlled negotiation history sits beside the final contract, proving exactly how terms were agreed.

- Granular search permissions give compliance officers instant access while protecting sensitive data under strict European privacy rules.

GDPR & Global Data-Privacy Obligations

- Data-Protection Challenges

- Contracts routinely embed personal data (client names, addresses, processing clauses). Regulations grant individuals the right to access or erase that data.

- CMS Safeguards

- Central visibility pinpoints every contract containing a given individual’s data, enabling swift fulfilment of “right-to-be-forgotten” requests.

- Role-based access controls, encryption and full logging ensure only authorised staff view personal data—and every access is recorded.

- Template management lets legal teams push updated privacy clauses across the entire contract library in one workflow.

Additional Frameworks Shaping Contract Strategy

| Regulation | Key Requirement | CMS Advantage |

|---|---|---|

| FINRA WORM | Broker-dealers must retain certain records in non-rewritable, non-erasable format. | WORM-configured repository prevents deletion or alteration. |

| AML / KYC | Enhanced due diligence on high-risk counterparties. | Integration with screening tools flags risky entities during contract creation. |

| Basel III & Prudential Rules | Rigorous vendor and service-provider oversight as part of operational-risk control. | Central registry of third-party contracts plus risk-scoring dashboards. |

| DORA (2025) | Inventory of all ICT-provider agreements and mandatory cybersecurity clauses (Article 30). | AI scanning locates vendor contracts, verifies clause presence, and triggers remediation workflows. |

Continuous Compliance: Staying Ahead of Moving Targets

Regulatory change is constant: LIBOR cessation, Brexit amendments, pandemic-era force-majeure clauses, new cyber-resilience rules. A modern Contract Management System delivers:

- AI-powered clause discovery to instantly surface impacted contracts (e.g., LIBOR references).

- Bulk-update workflows that generate and route amendments for e-signature in days instead of quarters.

- Regulation tags and dashboards so legal and compliance leaders track exposure by law, jurisdiction or business unit in real time.

By embedding these capabilities, contract management software transforms compliance from a reactive cost centre into a proactive, data-rich process that protects revenue, reputation and strategic agility. The result: every client agreement, trading contract and vendor deal remains fully aligned with the latest legal standards—today and as regulations evolve.

Key Features of Contract Management Software (CMS) for Compliance and Risk Management

Modern Contract Management Software (CMS) equips financial institutions with the exact controls regulators expect and the real-time insights risk teams need. Below are the must-have features, each mapped to a clear compliance or mitigation benefit, to look for when selecting or upgrading a Contract Management System.

1. Centralized Contract Repository

A single, encrypted repository, often cloud-based, houses every agreement (vendor contracts, client service agreements, ISDAs, NDAs, more). This unified “single source of truth” makes every document instantly searchable and audit-ready. Compliance officers gain full visibility into which agreements are active, what obligations apply, and where key clauses reside, capability that manual file shares can’t match.

2. Immutable Audit Trails & Robust Version Control

Every edit, comment, approval and e-signature is time-stamped and tied to a user ID, creating an indelible record of a contract’s life. These audit logs prove who did what, and when, while version control preserves every draft alongside the final executed copy. During regulatory examinations, this immutable history demonstrates control, segregation of duties and SOX-grade objectivity.

3. Pre-Approved Templates & Clause Libraries

Standardized templates and clause libraries ensure every contract uses the latest compliant language, whether for data-privacy terms, cybersecurity requirements, or interest-rate fallback clauses. Legal teams can push template updates globally in minutes, eliminating rogue wording that could trigger compliance gaps or legal exposure.

4. Automated Workflows, Approvals & Alerts

Configurable workflows route each contract through the correct review chain, legal, compliance, risk and executive sign-off, before execution. Automated approvals cut cycle time by up to 50 %, enforce segregation of duties, and trigger alerts for high-value deals or upcoming renewals. Nothing slips through the cracks, and every approval path is documented for audit defense.

5. Obligation Tracking & Proactive Milestone Alerts

Leading CMS platforms extract payment dates, renewal notice periods, regulatory filings and other obligations, then surface them on dashboards with automated reminders. By proactively managing obligations, finance firms avoid penalties, missed revenue opportunities and the estimated 40 % value leakage typical of poorly governed contracts.

6. Advanced Search & Custom Reporting

Keyword, metadata and clause-type search lets teams answer regulator questions, “show all contracts with X clause” or “list agreements with Vendor Y expiring this quarter”—in seconds. Custom reports reveal exposure to new laws (LIBOR, Brexit, DORA) and quantify compliance metrics, transforming audit prep from a fire drill into a routine query.

7. Bank-Grade Security & Granular Access Controls

Data encryption at rest and in transit, multi-factor authentication and role-based permissions keep sensitive financial data locked down. Whether respecting Chinese-wall restrictions in investment banking or satisfying GDPR data-protection mandates, a secure CMS prevents unauthorized access and logs every touchpoint for forensic readiness.

8. Seamless Integration with Enterprise Systems

Top-tier Contract Management Systems connect to enterprise legal management, procurement, CRM, e-signature, risk-scoring and compliance-monitoring tools. Integrated data flows mean, for example, that a closed-won deal in CRM spawns a draft contract in the CMS, or a sanctions-screening alert in a third-party risk platform flags the relevant contract for review, delivering a holistic GRC view.

9. Analytics & AI-Driven Insights

Built-in analytics dashboards track KPIs such as cycle time, renewal rates and clause deviation frequency. AI engines scan contracts to identify non-standard or high-risk language, score agreements, and recommend remediation. For finance teams, where a single word can alter risk posture, AI surfaces issues early and guides continuous process improvement.

Contract Lifecycle Stages in Finance: How Contract Management Software Adds Control, Speed & Compliance

Financial institutions handle a wide range of contract types, client agreements, ISDAs, vendor deals, loan documents, and each one must pass through eight distinct lifecycle stages. A modern Contract Management System (CMS), also known as contract management software or Contract Lifecycle Management (CLM) platform, embeds governance and automation at every step, turning a once-manual process into a strategic, compliance-driven engine.

1 | Contract Request & Authoring: Compliance-First Drafts

A CMS starts the lifecycle by offering smart request forms, pre-approved templates and curated clause libraries.

- Built-in playbooks guide users on acceptable terms, blocking risky or non-compliant language.

- Template logic auto-inserts mandatory clauses for anti-bribery, data protection, sanctions and other regulations.

- Alternate clauses (e.g., arbitration fallbacks) are selectable within policy limits, so the first draft is audit-ready and low risk.

2 | Review & Negotiation: Faster Cycles, Full Audit Trails

Internal reviewers add comments directly in the CMS; external mark-ups import seamlessly, preserving every redline.

- Version control captures every change and approver for evidentiary transparency.

- AI clause detection flags forbidden edits or missing disclosures in real time.

- Collaborative CLM tools routinely cut negotiation cycles in half, closing deals sooner without sacrificing oversight.

3 | Approval & Execution: Rules-Driven Sign-Off, Secure E-Signatures

Configurable workflows enforce segregation of duties, e.g., any contract above USD 5 million demands CFO and General Counsel approval.

- The platform blocks execution until all approvals are logged.

- E-signature integrations (DocuSign, Adobe Sign, etc.) collect signatures quickly and store completion certificates that show signer, timestamp and authentication method—critical evidence if validity is questioned later.

- Optional counterparty screening (sanctions, KYC) triggers just before signature for an extra compliance check.

4 | Storage & Repository Management: The Single Source of Truth

Once executed, the CMS becomes the system of record:

- Encrypted cloud repository indexes contracts by party, value, product line, jurisdiction and regulatory tag (SOX, MiFID II, GLBA, outsourcing, etc.).

- Retention rules (e.g., five years for SOX, seven for MiFID II) prevent deletion until legal requirements are met.

- Granular permissions ensure only authorised roles access sensitive agreements, supporting privacy mandates and Chinese-wall restrictions.

5 | Ongoing Management: Obligation Tracking & Continuous Compliance

Contracts rarely sit idle. The CMS automatically:

- Extracts obligations (payments, deliverables, covenants, certifications).

- Schedules alerts so teams act before deadlines.

- Dashboards give executives a real-time view of all upcoming commitments across the portfolio.

Missing obligations can bleed up to 40 % of contract value; proactive tracking virtually eliminates that leakage.

6 | Amendments, Renegotiations & Change Control

Regulations evolve (LIBOR transition, new privacy laws) and business needs shift. The CMS:

- Links every amendment to its parent contract, preserving lineage.

- Applies identical approval rules to changes as to originals, maintaining governance.

- Supports bulk amendment campaigns, e.g., injecting a new cybersecurity rider into thousands of vendor contracts, while reporting progress in real time.

7 | Renewal or Termination: No Surprises, Maximum Leverage

Well before expiry or auto-renewal, automated alerts prompt review:

- Teams confirm the agreement still meets current regulations and business goals.

- Renewal workflows launch renegotiation, consolidation or termination notices from templates, avoiding costly roll-overs or service gaps.

- Portfolio reports surface contracts—with total value and counterparty detail—up for renewal in each quarter, enabling data-driven sourcing strategies.

8 | Auditing & Continuous Improvement: Proof on Demand

Internal auditors, external firms and regulators can access read-only dashboards or pre-built reports instead of chasing paper.

- One-click queries answer “Show all contracts with X clause signed in 2024” or “List every agreement governed by UK law.”

- Approval logs, immutable histories and user-permission matrices demonstrate robust internal controls.

- Post-audit findings feed back into templates and workflows, driving a loop of continuous compliance enhancement.

From Reactive to Proactive Contract Governance

By embedding these controls, analytics and automations, Contract Management Software transforms the entire lifecycle into a transparent, data-rich process. Contracts move faster, value leaks close, and regulatory demands are met with confidence, freeing finance teams to focus on strategic growth rather than fire-drill compliance.

Leveraging AI & Advanced Analytics in Contract Management Software

1 | Automated Contract Review & Real-Time Risk Flagging

AI models scan thousands of pages in minutes, pinpointing clauses that exceed your institution’s risk tolerance, uncapped indemnities, limited termination rights, non-standard regulatory language and more. Internal benchmarks show:

- ~40 % faster first-pass reviews when AI compares incoming language against predefined playbooks.

- Full-portfolio clause validation, for example, confirming every ICT vendor contract contains new DORA-mandated cybersecurity terms.

Attorneys focus only on flagged exceptions, boosting accuracy while shrinking turnaround time.

2 | AI-Driven Obligation Extraction & Tracking

Machine-learning algorithms pull structured data, payment schedules, renewal windows, reporting covenants, certification deadlines, directly from executed agreements. The CMS then:

- Auto-populates obligation dashboards so no critical date is missed.

- Triggers alerts if a financial covenant is breached or a vendor’s certification lapses.

- Feeds analytics that prove to regulators the organisation knows, and actively manages, every contractual commitment.

Result: zero overlooked obligations and a tangible reduction in penalty exposure.

3 | AI-Assisted Drafting & Negotiation Guidance

Large-language models embedded in the CMS act as a digital co-counsel:

- Suggesting compliant clauses as users draft (“Add GDPR-compliant data-sharing language here”).

- Highlighting deviations from standard terms the instant a counterparty redlines a document.

- Explaining downstream implications (“Removing this regulatory-change termination right may conflict with forthcoming DORA guidance”).

Negotiations accelerate while novice drafters gain expert guardrails.

4 | Analytics Dashboards for Strategic Decision-Making

Beyond AI, advanced analytics convert contract data into actionable intelligence:

- Risk heat maps expose concentration of high-risk clauses by business unit or geography.

- Cycle-time metrics reveal bottlenecks so teams can refine templates or training.

- Value-capture analysis shows whether negotiated savings, volume discounts or revenue escalators are actually realised over the contract term.

Legal and compliance leaders move from reactive reviewers to data-driven advisors.

5 | Regulatory Change & Mass-Amendment Case Studies

AI has already proven indispensable in large-scale compliance projects:

- LIBOR sunset: AI identified every LIBOR reference across tens of thousands of contracts and suggested fallback language, enabling banks to meet transition deadlines without armies of reviewers.

- Smart-contract governance: Early pilots use AI to verify that blockchain-based smart-contract code mirrors legal terms, ensuring automated trades stay within regulatory bounds.

These examples underscore how AI in contract management software scales human expertise for fast-moving regulatory demands.

Selecting the Right Contract Management System for Financial Institutions

1 | Define Business, Compliance & Volume Requirements

- Stakeholder discovery: Gather input from legal, compliance, procurement, sales, IT and risk management.

- Must-have features: Immutable audit trails, regulation-specific modules (e.g., FINRA, GDPR), configurable approval matrices, cloud vs. on-premises deployment.

- Contract profile: Map annual contract volume and complexity, 500 simple NDAs demand different scale than 50 000 multi-party ISDAs.

2 | Validate Security & Regulatory Capabilities

- Bank-grade security: Encryption in transit/at rest, SOC 2 Type II, ISO 27001, robust disaster-recovery SLAs.

- Granular access controls: Role-based, field-level and Chinese-wall restrictions protect confidential data.

- Audit readiness: Built-in logs and reports that demonstrate SOX, MiFID II and GDPR compliance on demand.

3 | Assess Vendor Reputation, Roadmap & Ecosystem

- Market leadership: Prioritize vendors recognized by analyst evaluations (Magic Quadrant, Wave, etc.) and proven in financial services.

- Innovation track: Ensure continuous investment in AI, analytics and regulatory updates.

- Ecosystem depth: Look for integration partners, active user communities and reference clients.

4 | Ensure Seamless Integration & IT Alignment

- Tech-stack fit: Confirm APIs and pre-built connectors for CRM, ERP, e-signature, document management, trading platforms and risk systems.

- SSO & identity management: Support for enterprise authentication standards enhances security and user adoption.

- Data-flow continuity: Prevent silos by enabling bidirectional updates between the CMS and core finance applications.

5 | Prioritize User Experience & Adoption Support

- Intuitive UI: Modern interface, drag-and-drop creation, clause suggestions and chat-based search encourage daily use.

- Onboarding services: Vendor-led data migration, template setup and role-specific training accelerate time to value.

- Change management: Communicate benefits, redefine roles (e.g., CLM administrator) and promote company-wide adoption.

6 | Balance Configuration Flexibility vs. Custom Coding

- Rule engines & template builders: Model unique approval matrices, multilingual clauses and jurisdiction-specific rules without heavy development.

- Conditional logic: Automatically insert GDPR, outsourcing or data-localization clauses based on contract context.

- Maintainability: Avoid bespoke code that inflates long-term cost of ownership.

7 | Verify Scalability & Performance Under Growth Scenarios

- Contract and user load: Confirm the vendor’s largest live deployment and benchmark search/report speeds on complex, 500-page agreements.

- Cloud elasticity: Ensure the platform scales seamlessly during acquisitions or market expansion.

- High-volume analytics: Validate real-time dashboards remain responsive at tens of thousands of records.

8 | Build a Quantified ROI & Risk-Reduction Case

- Hard savings: Faster negotiation cycles, shorter revenue-recognition delays, lower administrative hours.

- Risk avoidance: Reduced exposure to regulatory fines and missed renewals.

- Soft benefits: Improved client satisfaction, stronger supplier relationships, streamlined audits.

9 | Secure Executive Buy-In & Plan Change Management

- Executive sponsorship: Engage the General Counsel, CCO, CIO and CFO early for budget and policy alignment.

- Security review: Involve IT risk teams to vet controls and eliminate deployment roadblocks.

- Communication strategy: Highlight efficiency gains and compliance safeguards to drive employee enthusiasm.

10 | Pilot, Measure & Roll Out in Phases

- Proof of concept: Start with a single department (e.g., procurement) or contract type to validate workflows and KPIs.

- Iterative migration: Onboard new contracts first, then batch-load legacy agreements—leveraging AI extraction to speed data capture.

- Continuous refinement: Use pilot metrics to optimise templates, workflows and user training before enterprise expansion.

FAQs on Contract Management Software (CMS) for Financial Services

What is a Contract Management System in finance, and why does it matter?

A Contract Management System (CMS) is a secure, central hub that governs every stage of a contract’s life cycle for banks, insurers, asset managers and fintech firms. By enforcing approved templates, logging every change in an immutable audit trail and sending deadline alerts, a CMS shields financial institutions from compliance lapses under SOX, Dodd-Frank, MiFID II, GDPR and other rules. It also drives efficiency: instead of hunting through email chains or shared drives, teams locate any agreement, or its renewal date, in seconds and act on it before risk or revenue slips away.

How does contract management software ensure regulatory compliance?

Contract management software embeds compliance into daily workflows:

- Single source of truth – All contracts sit in one encrypted repository, eliminating the chance an outdated agreement escapes oversight.

- Pre-approved templates & clause libraries – Every draft automatically includes required language (e.g., Section 404 controls, GDPR processing terms).

- Complete audit trails – The system records who reviewed or approved each version, satisfying internal-control evidence for regulators.

- Obligation and reminder engine – Automatic alerts ensure mandated tasks (annual vendor risk reports, swap trade filings, etc.) happen on time.

- Regulatory tagging – Users can instantly pull every “CCAR vendor” or “EMIR trade” agreement when rules evolve, then bulk-amend if needed.

Which CMS features matter most to financial institutions?

- Bank-grade security (encryption, MFA, SOC 2 certification).

- Comprehensive audit trails & version control.

- Configurable workflows that mirror complex approval hierarchies.

- Template and clause libraries for consistent, compliant language.

- Obligation tracking & automated alerts for renewals, filings and covenants.

- Advanced search & reporting to answer clause or counterparty queries instantly.

- AI analytics for risk scoring and clause deviation detection.

- Robust integrations with CRM, ERP, e-signature, risk and trading platforms.

- Retention-policy enforcement to meet record-keeping mandates.

Is contract management software secure enough for banks?

Yes—when firms select a reputable vendor and configure controls correctly. Leading CMS platforms use AES-256 encryption for data in transit and at rest, enforce role-based permissions and support SSO with multi-factor authentication. Independent audits (ISO 27001, SOC 2 Type II) validate their controls, and many offer region-specific hosting or on-premises deployment. Compared with emailing draft contracts, a CMS actually reduces leakage risk by centralizing access and logging every view or download.

CMS vs. CLM: What’s the difference?

- CMS refers to the software solution that stores, tracks and automates contracts.

- CLM describes the end-to-end business process of managing contracts from request through renewal or termination.

In practice, modern platforms deliver both; you need only one comprehensive system to support the full contract life cycle.

How does AI in contract management benefit finance legal teams?

AI accelerates and strengthens compliance by:

- Flagging non-standard or high-risk clauses during review.

- Extracting key data (parties, dates, covenants) from legacy contracts to populate the CMS automatically.

- Answering natural-language questions about the contract repository (e.g., “Which ISDAs allow termination for convenience?”).

- Monitoring regulatory updates and mapping them to affected agreements for bulk amendment campaigns.

Attorneys focus on strategic judgment while AI handles repetitive scanning and data entry.

What ROI can a financial firm expect from contract management software?

- Cost savings: 10–30 % reduction in administrative spend by automating drafting, approval and storage.

- Faster revenue capture: Negotiation cycles shrink by up to 50 %, accelerating deal closure and cash flow.

- Risk mitigation: Fewer fines or disputes due to airtight compliance and on-time obligation management.

- Recovered value: Tracking renewals and price-adjustment clauses helps reclaim the 9 % of revenue often lost through poor contract governance.

Payback commonly arrives within 12–24 months.

Can a CMS handle complex agreements like ISDA contracts?

Absolutely. Top-tier systems support nested schedules, annexes and protocol updates, let users define custom metadata (e.g., LEIs, swap types) and maintain granular version histories. Obligation calendars can track margin calls or covenant resets, while analytics flag which counterparties still need to adhere to new protocols or fallback language.

How does a CMS integrate with other financial systems?

Open APIs and pre-built connectors link the CMS to CRM, ERP, treasury, risk-management and e-signature tools. Data flows bi-directionally, so a “Closed-Won” deal in CRM spawns a draft contract, and an executed agreement updates the customer record. Integration eliminates re-keying, reduces errors and lets users operate within familiar interfaces.

Turning Contract Management into Competitive Advantage

In modern finance, Contract Management Software is not a back-office luxury; it is foundational infrastructure. By uniting stringent security controls with automation, analytics and AI, a robust CMS transforms contracts from static documents into dynamic assets:

- Compliance guardian—capturing every clause, approval and obligation with audit-ready precision.

- Efficiency engine—shortening cycle times, preventing missed renewals and freeing experts for higher-value work.

- Strategic insight hub—surfacing data that guides sourcing, pricing and risk decisions.

Firms that invest in a scalable, feature-rich Contract Management System demonstrate Experience, Expertise, Authoritativeness and Trustworthiness—qualities regulators respect and clients reward. In a landscape where regulations evolve and margins tighten, disciplined contract governance is the surest path to reduced risk, operational excellence and sustained growth.

Reduce your

compliance risks