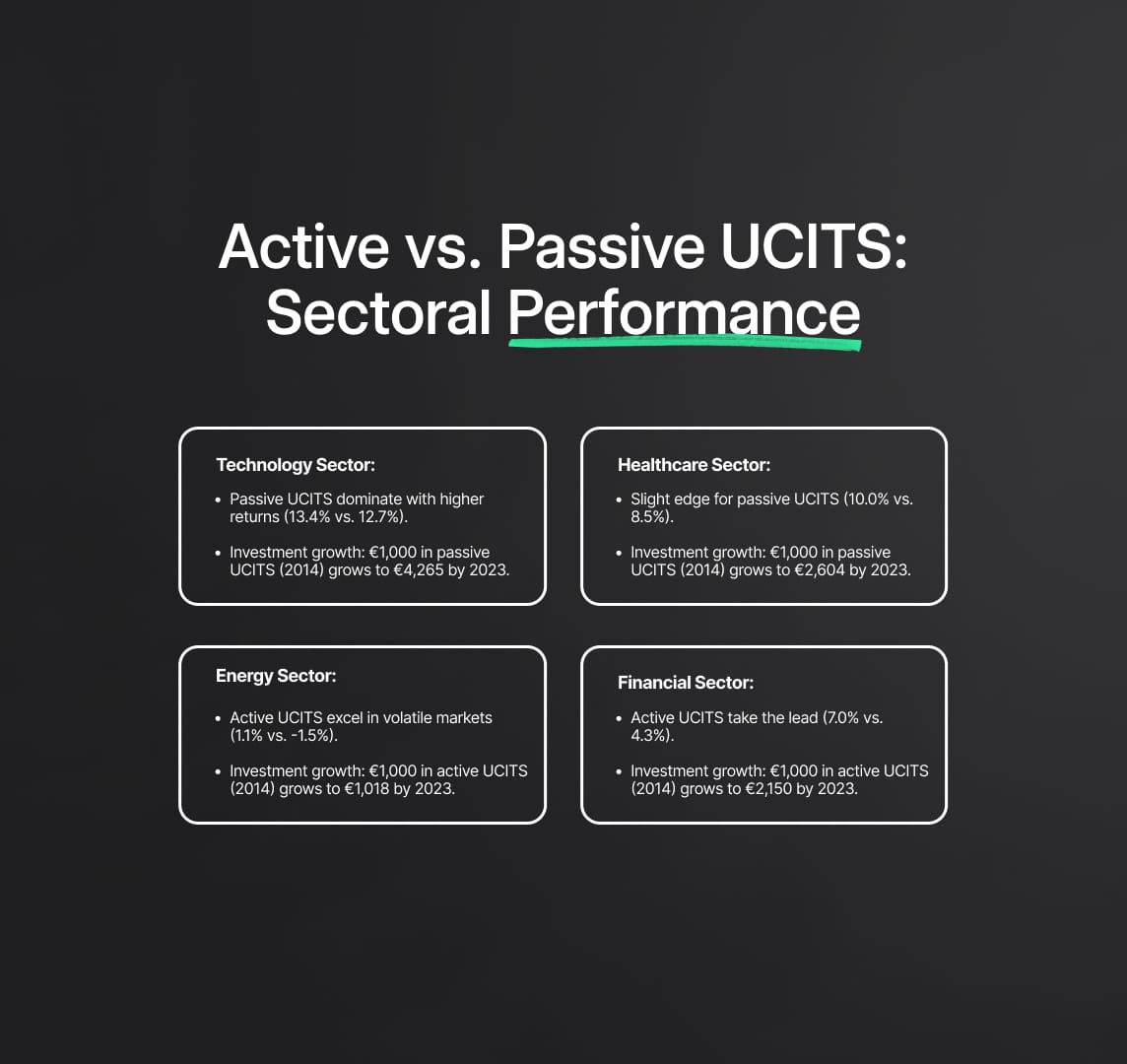

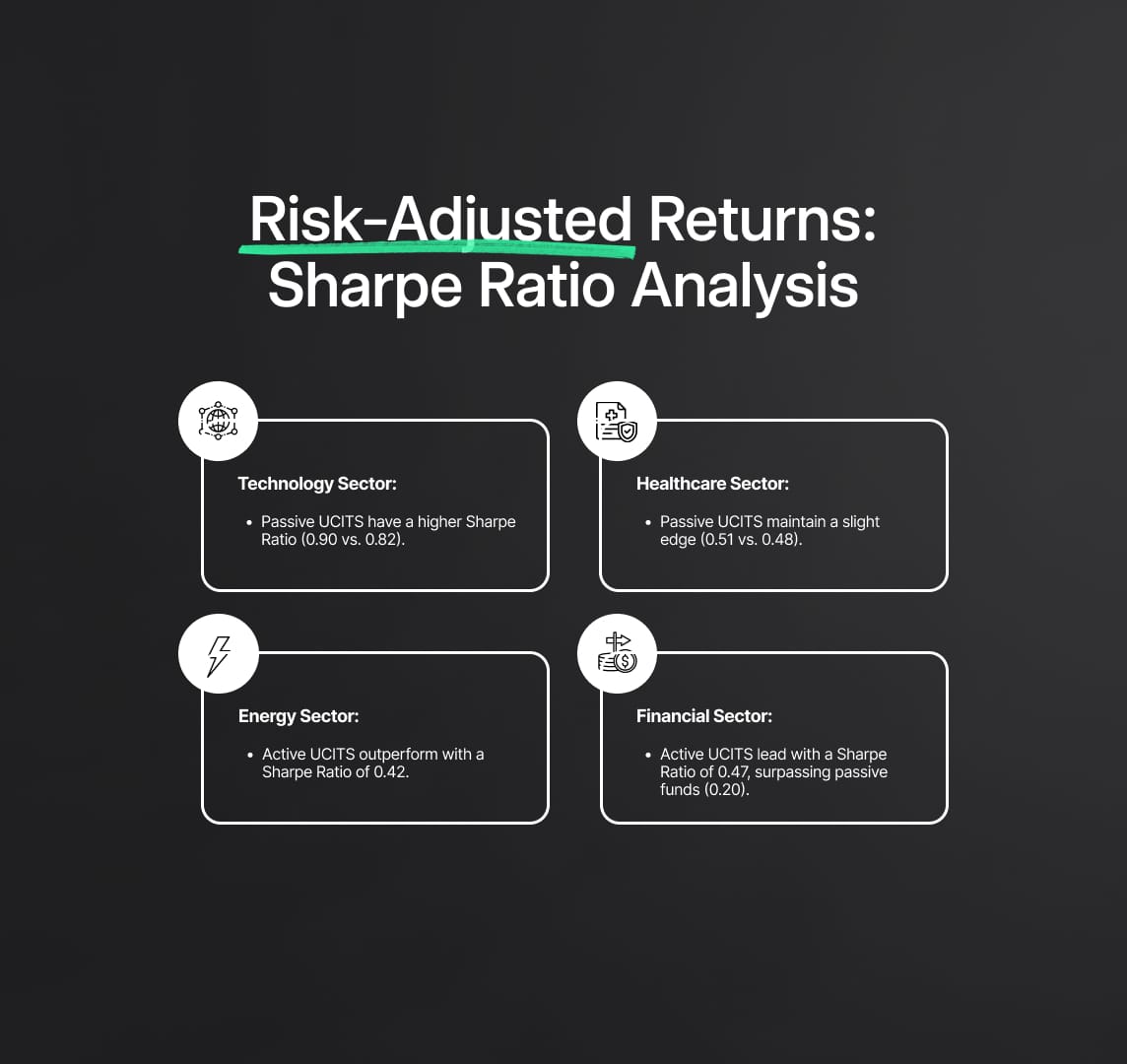

Active vs. Passive UCITS: EFAMA Sectoral Performance

The sectoral performance of UCITS highlights the differences between active and passive strategies. Passive UCITS dominate in technology and healthcare due to efficiency and scalability, while active UCITS excel in energy and financials by navigating volatility and complexities.

The Evolving European Financial Landscape: A Convergence of CMU, Fintech, and Regtech

The European Union is at a pivotal moment, driven by the urgent need to build a more competitive, resilient, and unified financial system. At the heart of this transformation is the Capital Markets Union (CMU), a critical initiative now inseparable from the powerful forces of Fintech and Regtech. Digitalisation is no longer a secondary consideration; it is the fundamental bedrock on which a modern, efficient, and truly single European capital market will be built. For financial institutions, technology innovators, and policymakers, mastering the synergy between the Capital Markets Union, Fintech innovation, and Regtech compliance is essential to unlocking Europe's economic potential and ensuring stability in a complex regulatory world.

The Capital Markets Union (CMU): A Renewed Push for European Competitiveness

The Capital Markets Union (CMU), designed to forge a single, integrated capital market across all EU member states, is undergoing a significant strategic revitalization. This renewed focus is a direct response to pressing economic and geopolitical challenges that highlight the critical need for deeper, more liquid, and accessible capital markets to secure the bloc's future prosperity and strategic autonomy.

Context for 2024-2025: The Strategic Imperative of the SIU

The current push to complete the Capital Markets Union is fueled by the stark reality that European competitiveness is waning, with productivity growth falling behind key global partners like the United States. There is a critical need to unlock and channel private investment towards strategic priorities, including:

- Defence and security infrastructure.

- The continent-wide digital transformation.

- The transition to a sustainable, green economy.

Despite its importance, the CMU project has been hampered for over a decade by divergent national interests and fragmented regulatory frameworks.

In response, the European Commission introduced its "Savings and Investments Union (SIU)" strategy in March 2025. This strategy absorbs the lessons from influential reports by figures like Mario Draghi and Enrico Letta, aiming to enhance financial system efficiency, broaden citizen access to capital markets, and improve financing options for European companies. This digital foundation is where Fintech innovation and Regtech solutions become indispensable. As noted by financial regulators, approximately half of all digitalization initiatives directly impact the capital market, making it impossible to regulate the market without a comprehensive digital strategy.

Geopolitical Drivers and the 'Savings and Investments Union' Rebrand

The drive for a Capital Markets Union is now fundamentally a geopolitical necessity. It is framed as essential for enhancing the EU's "open strategic autonomy" and strengthening its resilience. The ability to finance critical sectors internally is paramount. This geopolitical urgency may provide the political will needed to overcome long-standing barriers like national protectionism.

The rebranding to the "Savings and Investments Union" is a strategic move to combat "CMU fatigue" and broaden the project's appeal. By emphasizing benefits for individuals, such as improved pension outcomes, the Commission aims to build wider public support to push through necessary and challenging reforms.

Core Objectives of the Integrated Capital Market

The primary goal is to merge the EU's 27 national capital markets into a single system governed by common rules and harmonized oversight. The strategic objectives include:

- Fostering Innovation and Productivity: Creating an environment where capital flows freely across borders to fund innovative start-ups and scale-ups, preventing high-growth "unicorns" from relocating outside the EU to secure financing.

- Mobilizing Private Savings with Fintech: Unlocking the more than €10 trillion in European household savings, much of which sits in low-yield bank deposits. Fintech platforms are crucial for steering these savings towards productive, long-term investments in strategic sectors.

- Reducing Bank Dependency: Shifting from a heavy reliance on bank financing (currently ~70% of corporate funding in the EU vs. ~20% in the US) towards more diverse, market-based solutions.

- Strengthening Venture Capital: Addressing the paradox of high savings yet a fragmented and illiquid venture capital market, a structural inefficiency that stifles innovation.

Persistent Fragmentation: The Hurdles Facing the CMU and the Role of Regtech

Despite clear objectives, the path to a unified market is blocked by deeply entrenched challenges that prevent capital from flowing efficiently. Key hurdles include:

- Divergent National Frameworks: Significant differences in national laws governing insolvency, company structures, and taxation create major barriers. The "debt bias" in many tax systems actively discourages the equity investment the CMU aims to promote.

- Incomplete Financial Architecture: The EU’s banking union, a vital pillar for financial stability, remains incomplete, further complicating cross-border integration.

- Supervisory Fragmentation and the Regtech Solution: Differing supervisory practices across member states hinder the consistent application of EU rules. Regtech presents a critical solution, offering the technology to streamline compliance, harmonize reporting, and automate oversight, thereby reducing the regulatory burden and fostering trust in a unified market.

The Indispensable Role of Digitalization in CMU Success

Digitalization is the fundamental catalyst for the Capital Markets Union (CMU), essential for creating an efficient, transparent, and truly integrated European market. The EU's Digital Finance Strategy is directly aligned with the CMU, aiming to eliminate fragmentation in the Digital Single Market and build a data-driven financial ecosystem. This strategy supports the Capital Markets Union by prioritizing EU-wide digital identities, open finance, and the creation of a European financial data space.

Key Digital Initiatives Driving the Capital Markets Union

Several concrete initiatives are transforming the CMU's digital foundation, directly linking technology with market integration. As emphasized by Germany's financial regulator, BaFin, approximately half of all digital regulations directly affect the capital market, making it impossible to separate the two.

- European Single Access Point (ESAP): A cornerstone of the CMU, ESAP will provide centralized, EU-wide access to financial and sustainability data on European companies. By increasing market transparency and simplifying investment analysis, this platform is a game-changer for investors. ESAP is set to be fully operational by summer 2027, with the European Securities and Markets Authority (ESMA) leading its implementation.

- DLT Pilot Regime: This regulatory sandbox allows for controlled experimentation with Distributed Ledger Technology (DLT) for trading and settlement. The regime is specifically designed to foster Fintech innovation in critical market infrastructures, paving the way for next-generation financial systems.

- Digital Operational Resilience Act (DORA): This regulation establishes a robust framework to ensure all financial entities can withstand and recover from ICT-related threats. DORA creates mandatory standards for digital resilience, empowering Regtech solutions that help firms manage cyber risk and safeguard the entire system's stability.

Balancing Innovation with Digital Risk Management

While digitalization accelerates the Capital Markets Union, it also introduces significant operational risks, from cybersecurity threats to data privacy concerns. If not managed proactively, these digital-age risks could undermine the CMU by creating new forms of market fragmentation.

Proactive regulatory frameworks like DORA are therefore crucial for mitigating these vulnerabilities. The success of digital tools like ESAP depends entirely on the quality and security of the underlying data and the resilience of the digital infrastructure supporting them.

Data as the New Capital: Fueling Fintech and Regtech

A profound shift is underway where access to high-quality data is becoming as vital as financial capital itself. The strategic focus on ESAP and a "European financial data space" confirms this trend. This elevation of data's role demands robust governance, common EU data standards, and stringent security. Ultimately, this sophisticated and trustworthy data infrastructure is the essential foundation upon which the next generation of Fintech and Regtech solutions for the Capital Markets Union will be built.

Fintech and Regtech: Twin Engines for the Capital Markets Union

Within the EU's digital transformation, Fintech (financial technology) and Regtech (regulatory technology) have emerged as the twin engines driving the success of the Capital Markets Union (CMU). They are fundamentally changing how capital markets operate, how services are delivered, and how compliance is managed.

Fintech accelerates transactions and information flow, making it easier for businesses and investors to access capital across Europe while enhancing market transparency. Complementing this, Regtech leverages technology to help firms navigate complex regulations more efficiently and cost-effectively.

The Synergy Revolutionizing Market Operations

The convergence of Fintech and Regtech is a critical transformation, not an incremental trend. This synergy unlocks new efficiencies through:

- Advanced algorithms for data analysis and decision-making.

- The application of blockchain and DLT for secure, transparent record-keeping.

- Real-time data analytics for immediate market insights.

- Automation of compliance and reporting processes.

This technological fusion is imperative for any financial institution aiming to maintain a competitive edge and ensure operational resilience.

Regulatory Perspective: The Need for a Harmonized Approach

The European Banking Authority (EBA) recognizes the immense potential of Regtech to boost efficiency and profitability. However, the EBA also cautions that regulatory parity is essential. A lack of harmonized rules across the interconnected Fintech, Regtech, and Insurtech sectors could create an uneven playing field and introduce contradictions that undermine the core strategy of the Capital Markets Union.

Bridging the Gap Between Innovation and Compliance

While symbiotic, the relationship between Fintech and Regtech has inherent tensions. The rapid pace of Fintech innovation constantly creates new products and services, which in turn generate novel regulatory challenges. This can lead to a reactive cycle where Regtech solutions and official regulations lag, creating a risk gap. The early crypto-asset market, prior to the MiCA regulation, is a clear example of this danger. Closing this gap is vital for market stability.

A Cross-Border Blueprint for the CMU

The digital, cross-border nature of Fintech and Regtech provides a perfect testbed for the EU's single market ambitions. Successfully harmonizing rules and enabling these digital-native services to scale across the Union offers a valuable blueprint for achieving deeper integration in the broader Capital Markets Union. EU regulations like MiCA and PSD2 are already strengthening the single market by increasing transparency and simplifying cross-border activity, making Europe a more attractive hub for global digital finance.

Fintech: Revolutionizing European Capital Markets

Fintech is profoundly reshaping European capital markets by introducing innovative solutions that enhance efficiency, broaden access to capital, and challenge traditional financial models. This dynamic ecosystem is defined by powerful growth, strategic investment, and highly specialized players.

The European Fintech Ecosystem: Market Dynamics and Growth

The European Fintech market is experiencing explosive growth. After reaching USD 96.5 Billion in 2024, projections show the market expanding to USD 444.4 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 17.58%. This dynamism is underscored by a 21% growth in Fintech revenues in 2024, far outpacing the 6% rate of incumbent financial firms.

Following a 2023 slowdown, investment saw a modest recovery in 2024, marked by a strategic shift towards larger, more selective funding rounds. The UK remains Europe's top Fintech hub, with France and Germany emerging as strong challengers.

Key Factors Driving Fintech Growth

- Technological Integration: The rise of Insurtech, Decentralized Finance (DeFi) on blockchain, and open banking frameworks like PSD2.

- Digital Adoption: Increasing use of mobile devices for cashless transactions and digital identity verification systems.

- Market Needs: A growing focus on financial inclusion and more efficient digital payment solutions and mobile wallets.

Leading Players and Market Specialization

The landscape is maturing with a diverse array of specialized companies. Key niches include:

- Digital Banking: Revolut, N26, Monzo, Starling Bank.

- Payment Processing: Adyen (valued at ~$50.8B, Feb 2025), Checkout.com (valued at $9.3B, June 2023), Klarna, Wise, SumUp, Mollie.

- Global Super-Apps: Revolut (50 million users as of Nov 2024, reportedly seeking a $60B valuation in 2025).

- Compliance Technology (Regtech): A growing sector focused on automating regulatory processes.

Analysis: Market Concentration and the EU's Strategic Response

The trend towards selective funding suggests capital is flowing to mature, scalable Fintechs. This may lead to a market dominated by fewer, larger players in specialized areas like DLT infrastructure or AI-driven analytics.

While the UK maintains its lead post-Brexit, the strong growth of hubs in France and Germany signals a clear EU strategy. This internal push, backed by the Capital Markets Union and Digital Finance Strategy, aims to cultivate the EU's own Fintech champions, fostering a more multi-polar European landscape and enhancing the bloc's strategic autonomy.

Transformative Fintech Applications in EU Capital Markets

Fintech innovations are actively reshaping the European Union's financial landscape, with Artificial Intelligence (AI) and Distributed Ledger Technology (DLT) leading the charge. These technologies are not just enhancing but fundamentally rebuilding core components of the Capital Markets Union (CMU), from investment management and trading to payments and wealth management.

Artificial Intelligence (AI): The Augmentation Engine

AI and its subfields, Machine Learning (ML) and Generative AI (GenAI), are being deployed to boost operational efficiency, reduce costs, and enhance productivity across the financial sector.

The 'AI Value Paradox' in Investment Management

While there is significant investment in AI, its primary value currently lies in augmenting human expertise rather than in full autonomy.

- Primary Use: GenAI and Large Language Models (LLMs) are mainly used as a "copilot" to support human-driven investment decisions, improving cash flow management, portfolio rebalancing, and the analysis of alternative data.

- Market Data: An ESMA report from February 2025 confirmed that funds explicitly promoting AI represent a small niche of the market (€13 billion AuM, or 0.1% of UCITS AuM as of Q1 2024) and have shown mixed performance and recent investor outflows.

- Investment Trend: Despite this, a notable trend since 2023 is the significant increase in EU equity fund allocations to AI-related technology companies.

- Future Vision: The next evolution is "Agentic AI," where autonomous agents could execute tasks in retail banking, payments, and wealth management.

Regulatory Oversight: The EU AI Act and Regtech

The rapid adoption of AI introduces challenges like algorithmic bias and data quality management. The EU AI Act, which entered into force in August 2024, addresses these risks directly.

- High-Risk Classification: The Act classifies applications like credit scoring as "high-risk," imposing stringent requirements for risk management, data governance, and transparency.

- The Role of Regtech: This regulation creates a critical role for Regtech solutions. Regtech platforms will be essential for firms to manage, document, and prove their compliance with the AI Act's demanding framework, turning a regulatory burden into a streamlined process.

Distributed Ledger Technology (DLT): Rewiring Market Infrastructure

DLT and blockchain promise to revolutionize EU capital markets by improving efficiency in trading and post-trading, reducing operational costs, and enabling new forms of financing, all core goals of the Capital Markets Union.

The EU DLT Pilot Regime: A Sandbox for Innovation

Applicable since March 2023, the DLT Pilot Regime provides a regulatory sandbox for experimenting with DLT in the trading and settlement of tokenized financial instruments. It is a key enabler for fostering innovation in market infrastructures like DLT-based trading facilities and settlement systems.

Central Bank Exploration: The Path to a Unified Ledger

The European Central Bank (ECB) is actively exploring DLT for wholesale settlement. From May to November 2024, it successfully conducted trials with national central banks (including in Germany, Italy, and France) to test various DLT interoperability solutions. This work confirms the viability of DLT for high-value transactions and is now advancing on a dual track: interim integration with the existing TARGET system and long-term exploration of a "European unified ledger."

Tokenization in Practice: The EIB Digital Bond

Tokenization, the process of converting rights to an asset into a digital token on a blockchain—is a transformative application of DLT. It can reduce intermediary costs, enable 24/7 settlement, and democratize access to investments through fractional ownership. A landmark example was the European Investment Bank's (EIB) issuance of a €100 million digital bond in April 2021 on the Ethereum public blockchain, signaling strong market viability for such innovations.

However, adoption remains incremental due to challenges in liquidity management (as instant settlement requires pre-funding) and integration with legacy systems.

Wider Fintech Innovation: Reshaping Core Financial Services

Beyond AI and DLT, Fintech continues to drive significant change across other key financial services:

- Payments: Firms like Adyen and Revolut are setting new standards for payment processing. The Open Banking framework (PSD2 and the upcoming PSD3) is a major catalyst for competition and innovation.

- Lending: P2P lending, equity crowdfunding, and AI-driven credit scoring are creating new financing avenues, particularly for Micro, Small, and Medium-sized Enterprises (MSMEs).

- Wealth Management: Robo-advisors and automated portfolio management platforms are democratizing access to sophisticated investment strategies for retail investors.

Fintech's Impact Across Specific Market Segments

While Fintech democratizes finance, it also faces rising compliance costs from new regulations like MiCA for crypto-assets. This evolving landscape creates a significant opportunity for Regtech providers to help firms navigate complexity, but it may also favor larger players with more resources.

- Bond Markets: The use of electronic trading platforms (ETPs) and sophisticated order management systems is growing, enhancing liquidity and transparency. Tradeweb's launch of electronic portfolio trading for European government bonds is a key development.

- Derivatives Markets: This segment is seeing growth in crypto-asset derivatives and the exploration of DLT for market infrastructure, with regulations like MiFIR adapting to these changes.

- Post-Trade: Fintech solutions, particularly API frameworks, are modernizing post-trade processes like clearing, settlement, and custody, enabling automation and streamlining compliance for institutional firms.

Value with Fintech: Core Benefits for the Capital Markets Union

The proliferation of Fintech across Europe is yielding tangible benefits that directly support the core objectives of the Capital Markets Union (CMU). It delivers enhanced efficiency, greater transparency, and improved access for both businesses seeking capital and investors seeking opportunities.

For Businesses and SMEs: Expanding Access to Capital

Fintech is revolutionizing the funding landscape for businesses, especially for Small and Medium-sized Enterprises (SMEs), which are the backbone of the European economy.

- Diverse Funding Sources: Fintech platforms provide access to equity crowdfunding, peer-to-peer (P2P) lending, and venture capital networks, offering vital alternatives to traditional bank financing.

- Seamless Cross-Border Transactions: Solutions for faster and cheaper international payments are crucial for SMEs expanding across the EU, a key goal of the single market.

- Operational Efficiency: Automated financial management tools, digital invoicing, and specialized banking services help SMEs optimize cash flow and streamline operations.

For Investors: Democratizing Opportunities and Wealth Management

Investors at all levels are gaining from a wider array of options and more accessible services, helping to create a more inclusive investment culture across the Capital Markets Union.

- Democratized Access: Fintech platforms open up asset classes previously out of reach for many retail investors, such as tokenized assets, international equities, and specialized funds.

- Accessible Advice: Robo-advisors offer personalized, algorithm-based investment advice at lower costs, making wealth management more attainable.

- Enhanced Experience: Digital platforms provide superior user experiences, real-time portfolio access, and greater transparency on fees and performance.

For the Market: Driving Efficiency and Transparency

Fintech enhances overall market efficiency by reducing friction and costs. Algorithmic trading improves price discovery, while automation in processes from client onboarding to settlement cuts operational delays. Technologies like Distributed Ledger Technology (DLT) provide immutable, auditable transaction records. Furthermore, regulatory initiatives like Open Banking (PSD2) and the European Single Access Point (ESAP) use technology to foster data sharing and centralize corporate information, boosting market-wide transparency.

Navigating the 'Financial Inclusion Paradox'

While Fintech holds the promise of greater financial inclusion, a potential paradox exists. Access to digital solutions requires a certain level of digital literacy and technological access. Without conscious policy efforts and inclusive design, Fintech could inadvertently widen the gap for the digitally excluded. Realizing its full democratizing potential requires ensuring that innovation benefits all segments of the population.

Fintech Adoption Challenges in the EU

Despite its transformative potential, the integration of Fintech within the Capital Markets Union faces significant hurdles, from navigating regulatory mazes to managing new forms of risk. Overcoming these challenges is critical for Europe's global competitiveness.

Key Operational and Regulatory Barriers

The primary drivers for the adoption of Regtech solutions stem from the need to manage the following key challenges:

- Regulatory Complexity: Navigating the dense, evolving patchwork of EU and national rules—including MiCA, DORA, the AI Act, GDPR, and AML directives—is a major resource drain for firms, especially those operating cross-border.

- Legacy Technology: Integrating agile Fintech solutions with the often outdated and complex IT systems of incumbent institutions is a costly and time-consuming barrier to innovation.

- Talent Competition: The intense competition for a highly skilled workforce in data science, AI, and cybersecurity is a persistent challenge for both startups and established players.

- Cybersecurity and Operational Risks: Increased digitalization elevates the risk of sophisticated cyber-attacks and system disruptions, demanding robust security frameworks.

- Cost of Compliance: The substantial financial outlay required for innovation and adherence to stringent regulations can be a significant barrier, particularly for smaller firms.

The Core Challenge: The 'Innovation Trilemma'

Regulators and the industry face a fundamental "innovation trilemma": the difficulty of simultaneously achieving three often-conflicting goals:

- Fostering Financial Innovation.

- Maintaining Market Integrity and Financial Stability.

- Providing Clear, Predictable Rules.

An excessive focus on one area can harm the others. For example, fear of "overzealous legislation" creating a "complexity spiral" that stifles innovation is a primary concern. The EU's approach attempts to strike a balance through risk-based rules and controlled environments like regulatory sandboxes.

Related Risks: Regulatory Arbitrage and 'Innovation Washing'

This trilemma can lead to secondary risks. Discrepancies in national enforcement may create opportunities for regulatory arbitrage, where firms seek jurisdictions with lighter rules, undermining the CMU's level playing field. It can also lead to superficial adoption of technology, or "innovation washing", where firms adopt AI or blockchain for appearances without genuine integration, a practice of which regulators like ESMA are wary.

Fintech Growth: The Role of EU Digital Infrastructure and Funding

The growth of the European Fintech ecosystem is strategically supported by two foundational pillars: the development of shared Digital Public Infrastructure (DPI) and the targeted deployment of EU funding. Together, these elements create a fertile ground for innovation and are critical for building a globally competitive Capital Markets Union (CMU).

Digital Public Infrastructure (DPI): The Foundation for a Single Market

Robust DPI, the shared digital systems and standards available to all, is essential for lowering entry barriers, promoting fair competition, and ensuring seamless interoperability across the EU. Key DPI initiatives include:

- Electronic Identification (eIDAS): This EU-wide regulation provides a secure framework for electronic identification and trust services, which is fundamental for digital customer onboarding, secure authentication, and enabling frictionless cross-border financial transactions.

- European Financial Data Space & ESAP: The European Single Access Point (ESAP) is a form of DPI designed to centralize access to company financial and sustainability data. This creates a valuable public data resource that empowers Fintech firms to build advanced analytical tools and investment platforms.

- Open Banking Frameworks (PSD2/PSD3): These regulations compel banks to provide secure API access to customer data (with consent). This creates a foundational DPI layer that enables Fintechs to innovate in payments, account aggregation, and personalized financial services.

- Digital Euro: The ECB's ongoing exploration of a digital euro represents a potential major evolution in public payment infrastructure, which could offer new rails for Fintech innovation in payments and programmable money.

Strategic EU Funding: Cultivating European Fintech Champions

EU funding programs are a cornerstone of the strategy to cultivate "European tech champions," reduce reliance on foreign capital, and foster the bloc's technological sovereignty.

Horizon Europe

As the EU's flagship research and innovation program (2021-2027), Horizon Europe has already funded over 15,000 projects with €43 billion. It provides a significant return, with an estimated €11 in GDP generated for every €1 invested, and supports startups with simplified measures like lump-sum grants.

European Innovation Council (EIC)

Positioned as Europe's leading deep-tech investor, the EIC bridges the funding gap for high-potential innovators. The EIC Fund has completed over 150 investment rounds and successfully mobilized over €2.6 billion in private co-investment, generating over €3 in additional investment for every €1 invested by the fund since 2020.

Targeted Fintech and Investment Programs

- FINE (Fintech Investment Network and Ecosystem): Funded by Horizon Europe, FINE acts as a vital bridge connecting European investors directly with Fintech startups and SMEs.

- InvestEU Programme: This program uses the EU budget to de-risk innovative projects, attracting private sector investment into venture and growth capital to help fast-growing European companies scale.

Supportive Frameworks: Regulatory Sandboxes and Innovation Hubs

To support innovation while managing risk, the EU promotes controlled testing environments. These initiatives are crucial for the co-development of both Fintech products and the Regtech solutions needed to supervise them.

Regulatory sandboxes and innovation hubs, like the EU FinTech Lab, offer a supervised space where firms can test new business models. This facilitates a crucial dialogue between innovators and regulators, helping to identify regulatory hurdles early and allowing rules to adapt to new technology. The push for pan-European sandboxes aims to create a more predictable environment, supporting the cross-border scalability that is essential for the success of the Capital Markets Union.

Regtech: Ensuring Compliance and Stability in a Digital Age

As European capital markets undergo rapid digitalization, Regulatory Technology (Regtech) has become an indispensable pillar for ensuring stability and trust. By leveraging technology to streamline compliance and enhance risk management, Regtech plays a critical role in the successful functioning of a modern Capital Markets Union (CMU).

Automating Compliance in the Capital Markets Union

Regtech is the application of new technologies to address complex regulatory requirements more effectively and efficiently. In an era where Fintech innovation continuously reshapes financial services, Regtech bridges the critical gap between new technologies and the rules that govern them. It automates and enhances compliance, moving firms from a reactive to a proactive stance.

Market Growth and Projections

The demand for these solutions is fueling substantial market growth. The global Regtech market is projected to reach nearly $82 billion by 2033. The European market, specifically, shows powerful momentum:

- It was expected to grow by 23.0% to reach US$4.59 billion in 2024.

- The forecast for 2024-2029 indicates a strong CAGR of 15.3%, with the market value projected to increase from US$3.73 billion in 2023 to US$9.38 billion by 2029.

Key Drivers and Benefits of Regtech Adoption

The accelerated adoption of Regtech is driven by a convergence of regulatory pressure and technological advancement.

Primary Drivers:

- Regulatory Complexity: The increasing volume and intricacy of EU regulations, such as MiFID II/MiFIR, DORA, MiCA, and successive Anti-Money Laundering Directives (AMLDs), make sophisticated compliance tools essential.

- Cost Reduction: Financial institutions are under constant pressure to reduce operational costs, and Regtech delivers significant savings through automation.

- Technological Advances: The growing power of Artificial Intelligence (AI), Machine Learning (ML), and real-time data analytics provides the engine for more effective Regtech solutions.

Core Benefits for Financial Firms:

- Enhanced Governance: Streamlined processes and real-time monitoring of transactions and regulatory changes.

- Superior Reporting: Greater accuracy, speed, and data integrity for regulatory submissions.

- Robust Risk Management: Automation of compliance checks, leading to reduced operational risks and a stronger overall risk framework.

The Shift from Discretionary Tool to Operational Necessity

The sheer volume of new EU regulations (MiCA, DORA, AI Act, AMLD6, etc.) is transforming Regtech from an optional extra into a core operational necessity. For many institutions, particularly smaller firms with limited resources, manual compliance processes are no longer viable.

A key trend facilitating this shift is "Regtech-as-a-Service" (RaaS). This cloud-based, subscription model democratizes access to advanced compliance tools, allowing smaller firms to leverage powerful solutions without massive upfront investment. However, this trend introduces a new layer of risk: dependency on third-party providers. This heightens the importance of rigorous due diligence and third-party risk management, a practice explicitly mandated under regulations like DORA.

Targeted Regtech Solutions for Core EU Regulations

As the Capital Markets Union (CMU) matures, a landscape of complex, interconnected regulations has emerged. Regtech firms are developing highly specialized solutions to help financial institutions comply with these cornerstone EU rules, turning regulatory obligations into automated, efficient processes. Consistent, technology-enabled compliance is fundamental to creating the trusted and level playing field the CMU requires.

MiCA (Markets in Crypto-Assets Regulation)

MiCA governs the innovative Fintech world of crypto-assets. Regtech is essential for Crypto Asset Service Providers (CASPs) to operate within this new framework. Solutions focus on:

- Automated Licensing and Reporting: Assisting CASPs with the authorization process, the submission of white papers, and ongoing regulatory reporting.

- AI-Driven Market Abuse Surveillance: Deploying AI to monitor crypto trading for manipulative activities like spoofing or wash trading, in line with ESMA’s guidelines.

- AML/CFT and KYC: Providing robust digital identity verification for crypto users and automated transaction monitoring to detect suspicious activity.

DORA (Digital Operational Resilience Act)

DORA establishes a stringent framework for ICT risk management across the financial sector. Regtech is crucial for firms to prove and maintain their digital resilience. Key solutions include:

- ICT Risk Management: Assisting firms in building and maintaining comprehensive risk frameworks, asset registers, and governance structures.

- Incident Reporting: Automating the detection, classification, and timely reporting of significant ICT-related incidents to authorities.

- Third-Party Risk Management: A major focus of DORA, with Regtech tools designed to assess, monitor, and manage risks associated with critical technology vendors.

MiFID II / MiFIR (Markets in Financial Instruments Directive/Regulation)

This framework imposes extensive reporting and transparency obligations. Regtech automates compliance with these data-intensive rules.

- Transaction Reporting: Automating complex reporting, including the expanded scope of the 2024 MiFIR review.

- Best Execution and Transparency: Providing tools for best execution analysis and ensuring compliance with pre- and post-trade transparency rules.

- ESG Compliance: Using AI to help firms match investors' ESG preferences with suitable financial products, complete with an audit trail.

AML/CFT Directives

Successive Anti-Money Laundering Directives require robust systems for customer due diligence. Regtech is at the forefront of modernizing these defenses.

- Automated Customer Onboarding: Streamlining Know-Your-Customer (KYC) checks using digital ID verification, biometrics, and automated screening against sanctions lists.

- Real-Time Monitoring: Employing AI and ML to monitor transactions for suspicious patterns, significantly reducing false positives and improving detection rates.

- Automated Reporting: Facilitating the automatic generation and submission of Suspicious Activity Reports (SARs) to financial intelligence units.

The Cutting Edge of Regtech: AI, ML, and Generative AI

Artificial Intelligence (AI), Machine Learning (ML), and especially Generative AI (GenAI) are the transformative forces shaping the future of Regtech. These technologies are moving compliance from a reactive, check-the-box exercise to a proactive, predictive, and integrated function.

Key AI-Driven Trends for 2025 and Beyond

- The GenAI Revolution: GenAI is rapidly being integrated into Regtech products to enhance AML/CTF efforts, combat financial scams, and accelerate compliance process development.

- Predictive Risk Management: AI/ML models are shifting from detecting past breaches to predicting potential compliance failures, allowing firms to take preemptive action.

- Regulatory Intelligence: Natural Language Processing (NLP) is used to automatically interpret vast quantities of regulatory text, enabling horizon scanning for new rules and mapping obligations to internal controls.

- Holistic, Integrated Platforms: The market is moving away from siloed compliance tools (e.g., separate KYC, AML, fraud systems) toward unified platforms that provide a single, comprehensive view of risk.

The Rise of SupTech: Regulators Adopt AI

Regulatory bodies themselves are increasingly adopting advanced technology, a field known as Supervisory Technology (SupTech). Supervisors are using AI and Big Data analytics for more effective market surveillance and data-driven supervision. Initiatives like ESMA's Data Platform provide the infrastructure for these capabilities, ensuring regulators can keep pace with a digitally transformed market.

Critical Hurdles for AI in Regtech

Despite the immense potential, significant challenges could slow the adoption of advanced AI in Regtech.

- The 'Black Box' Problem (Explainability): As AI models become more complex, making their decision-making processes transparent and understandable to regulators is a major hurdle. A firm must be able to explain why an AI flagged a transaction or denied a loan.

- The Specialized Talent Gap: The skills required to build, validate, and manage AI-driven Regtech, a blend of AI ethics, model validation, cybersecurity, and regulatory knowledge, are highly specialized and scarce. This talent shortage could create a bottleneck, particularly for smaller firms.

Addressing Regtech Challenges: From Implementation Failures to Supervisory Expectations

While Regtech offers powerful solutions, its implementation is not without significant risk. Failures in deploying and managing these technologies can lead to severe compliance breaches, attract supervisory scrutiny, and ultimately weaken the integrity of the Capital Markets Union (CMU) by creating inconsistencies in regulatory adherence.

The Pitfalls of 'Unthinking Reliance' on Technology

A primary concern highlighted by regulators is the "unthinking reliance" on new technologies. Deploying Regtech solutions without proper testing, validation, or adequate senior management oversight can paradoxically weaken an institution's controls rather than strengthen them.

The European Banking Authority (EBA) has observed that the improper use of new compliance technology has been a central factor in a substantial number of Anti-Money Laundering (AML) violations across the EU. This indicates a systemic issue in how some firms approach Regtech adoption, moving forward without a deep understanding of the tool's true capabilities and limitations.

Rising Supervisory Expectations for Regtech Governance

In response, supervisory bodies are signaling that they expect a higher standard of governance around technology adoption. It is no longer enough to simply purchase a Regtech solution; firms must prove they are using it correctly.

Regulators now expect compliance personnel to be fully apprised of the purpose, capabilities, and limitations of any tool they acquire. Experts advise that firms must extend their existing product governance frameworks to encompass Regtech, identifying its introduction as a formal risk factor. This requires dedicated monitoring and regular testing at the highest governance levels, rather than waiting for an internal audit to uncover critical flaws.

Core Challenges in Regtech Adoption

Several persistent challenges complicate the successful implementation of Regtech:

- Data Security and Evolving Regulations: Ensuring the security of sensitive data against evolving cyber threats while ensuring the Regtech solution remains agile enough to adapt to constant regulatory changes is a difficult balancing act.

- Integration with Legacy Systems: Integrating modern Regtech applications with older, often cumbersome, legacy IT infrastructures remains a significant technical and financial hurdle for many established institutions.

- Cost of Implementation: While the long-term goal is cost reduction, the initial investment required to acquire, implement, and maintain sophisticated Regtech platforms can be substantial, posing a particular barrier for smaller firms.

The EU's Digital Finance Framework

The European Union has constructed a comprehensive regulatory framework to govern the digital finance landscape, aiming to harness the innovation of Fintech while ensuring the stability and compliance managed by Regtech. These pillar regulations form the rulebook for a modern Capital Markets Union (CMU), creating a harmonized environment that fosters trust, protects consumers, and ensures market integrity.

Pillar Regulations Shaping Fintech and Regtech

MiCA: Markets in Crypto-Assets Regulation

- Objective: To establish a harmonized EU-wide framework for crypto-assets, ensuring transparency, financial stability, and investor protection. Key provisions have been applicable since mid-to-late 2024.

- Key Provisions:

- Creates a licensing regime for Crypto Asset Service Providers (CASPs) with requirements for capital, governance, and operational resilience.

- Mandates detailed disclosures through "white papers" for crypto-asset issuers.

- Establishes rules to prevent market abuse in crypto markets.

- Excludes crypto-assets that qualify as financial instruments under MiFID II.

DORA: Digital Operational Resilience Act

- Objective: To strengthen the digital operational resilience of the EU financial sector, ensuring all entities can withstand and recover from ICT-related disruptions. DORA has been applicable since January 17, 2025.

- Key Provisions:

- Mandates robust ICT risk management frameworks and governance structures.

- Establishes harmonized rules for ICT incident management and reporting.

- Requires regular digital resilience testing, including Threat-Led Penetration Testing (TLPT) for significant entities.

- Introduces a direct oversight framework for critical third-party providers like cloud services.

MiFID II / MiFIR: Markets in Financial Instruments Directive/Regulation

- Objective: To create fairer, safer, and more transparent financial markets while strengthening investor protection.

- Key Provisions:

- Governs the operation of investment firms and trading venues.

- Imposes extensive pre- and post-trade transparency and transaction reporting obligations.

- Sets rules for best execution and algorithmic trading.

- Defines what constitutes a "financial instrument," thereby determining whether a crypto-asset falls under MiFID II or MiCA.

AMLD: Anti-Money Laundering Directives and EU AML Package

- Objective: To prevent the use of the financial system for money laundering and terrorist financing.

- Key Provisions:

- Mandates robust Customer Due Diligence (CDD/KYC) procedures.

- Requires ongoing transaction monitoring to detect and report suspicious activities to Financial Intelligence Units (FIUs).

- The new EU AML package is establishing a central EU Anti-Money Laundering Authority (AMLA) to harmonize rules and strengthen supervision.

PSD2 / PSD3: Payment Services Directives

- Objective: To foster innovation, competition, and security in the European retail payments market, most notably by facilitating Open Banking.

- Key Provisions:

- Introduced requirements for Strong Customer Authentication (SCA) to enhance payment security.

- Mandates that banks provide regulated Third-Party Providers (TPPs) with secure API access to customer payment accounts (with consent).

The EU AI Act

- Objective: To establish harmonized, risk-based rules for the safe and transparent development and use of Artificial Intelligence. While in force since August 2024, most provisions become applicable from August 2, 2026.

- Key Provisions:

- Prohibits AI systems that pose an "unacceptable risk" (e.g., social scoring).

- Imposes strict obligations on "high-risk" AI systems, including those used for credit scoring or in critical infrastructure. These obligations cover risk management, data governance, human oversight, and cybersecurity.

- The Act is designed to complement sector-specific rules like DORA and MiCA, creating dual compliance requirements for AI used in finance.

The Challenge of the 'Cumulative Compliance Burden'

While each regulation serves a vital purpose, their combined weight creates a formidable compliance challenge. This "cumulative compliance burden" requires significant investment and expertise, particularly for smaller Fintech and Regtech firms. If not carefully managed, this could inadvertently favor larger incumbents, potentially stifling the innovation driven by agile startups that are crucial to a dynamic Capital Markets Union.

The 'Brussels Effect': The EU as a Global Regulatory Standard-Setter

The EU's role as a "first-mover" in comprehensive technology regulation (e.g., GDPR, MiCA, AI Act) presents both an opportunity and a challenge.

- The Opportunity: It can establish global standards, the "Brussels Effect", and give EU firms a competitive advantage built on trust and robust governance.

- The Challenge: If EU rules are significantly more stringent than those in other jurisdictions, EU firms could face higher initial costs and a temporary competitive disadvantage.

The long-term success of the EU's digital finance strategy will depend on the global convergence of these standards and the ability of this framework to remain adaptable to rapid technological change.

Supervisory Priorities for Digital Finance (2024-2025)

European and national supervisors are proactively shaping the digital finance landscape. Through detailed guidelines, strategic priorities, and direct engagement, authorities like ESMA, EBA, and BaFin are translating the EU's regulatory framework into practice, with a focus on fostering innovation while ensuring stability across the Capital Markets Union (CMU).

ESMA: Fostering Digital Markets and Investor Protection

The European Securities and Markets Authority (ESMA) is central to ensuring consistent application of securities law and driving supervisory convergence. Its recent priorities underscore the importance of digitalization.

- MiCA Implementation: ESMA has been instrumental in developing the detailed technical standards and guidelines for MiCA, covering market abuse prevention, reverse solicitation, and suitability assessments for crypto-assets. Many of these measures are set to apply during 2025.

- Advancing the Capital Markets Union: In its May 2024 Position Paper, ESMA issued 20 recommendations to build more effective EU capital markets, including promoting digital solutions to improve retail investor access and enhancing market infrastructure.

- Data Strategy: A key focus is on improving the quality and use of regulatory data through the ESMA Data Platform, aiming to reduce the reporting burden on firms and enhance supervisory capabilities, a core task for Regtech.

- Protecting Online Investors: ESMA is actively working to combat the promotion of unauthorized financial services and scams online, urging social media platforms to take more proactive steps.

EBA: Ensuring Banking Stability and Tech Parity

The European Banking Authority (EBA) oversees the banking sector, with its work increasingly intersecting with Fintech and Regtech.

- MiCA Collaboration: The EBA has worked closely with ESMA on MiCA standards for asset-referenced and e-money tokens, focusing on issuer governance, liquidity stress testing, and recovery plans, with many rules applying in 2025.

- Tech Ecosystem Oversight: The EBA advocates for regulatory parity across Fintech, Regtech, and Insurtech to prevent an uneven playing field. It is also a key participant in the EU Digital Finance Platform, which fosters dialogue between innovators and supervisors.

- Concerns Over Regtech Failures: Voicing significant concern, the EBA has highlighted that improper use and poor governance of new Regtech solutions have been central factors in a substantial number of AML compliance violations across the EU.

BaFin: A National Perspective on Implementation

Germany's Federal Financial Supervisory Authority (BaFin) provides a clear example of how EU regulations are implemented at the national level.

- MiCA in Practice: BaFin has been actively implementing MiCA since the rules for crypto-asset service providers (CASPs) became applicable on December 30, 2024. It emphasizes the need for thoroughly prepared license applications, as incomplete submissions risk rejection under MiCA’s tight deadlines.

- DORA and Cyber Resilience: In line with ECB priorities, BaFin is intensifying its supervision of financial institutions' digitalization strategies, IT risk, and cyber resilience to ensure alignment with DORA's stringent requirements.

- AML and the 'Travel Rule': BaFin highlights that under the Transfer of Funds Regulation (TFR), crypto service providers must verify ownership for transfers to self-hosted addresses exceeding €1,000, a key AML/CFT control.

The Challenge of Supervisory Convergence and Regulatory Arbitrage

A primary challenge for the Capital Markets Union is ensuring that these complex new rules are interpreted and applied consistently across all 27 member states. Fragmented supervision or divergent national interpretations can create opportunities for regulatory arbitrage, where firms seek jurisdictions with a perceived lighter regulatory touch. This undermines the level playing field of the single market. The establishment of the new EU Anti-Money Laundering Authority (AMLA) and the convergence efforts of ESMA and the EBA are designed to combat this risk directly.

The Overarching Threat of Cybersecurity

Cybersecurity is a pervasive threat that cuts across all aspects of the CMU. The increasing reliance on third-party ICT providers and the sophistication of cyber threats pose a significant risk to financial stability. While DORA provides a critical baseline for resilience, the threat landscape is constantly evolving. The ENISA Threat Landscape report highlights prime threats for the finance sector, including DDoS attacks, ransomware, and supply chain attacks, underscoring the multifaceted risks that all financial entities must manage to maintain trust in the digital ecosystem.

Imperatives for a Digital-First Capital Markets Union

To thrive in the EU's evolving digital financial landscape, institutions must move beyond reactive compliance to a proactive, strategic posture. The successful navigation of the Capital Markets Union (CMU) requires a clear focus on the following four imperatives, with implementation timelines that are both pressing and immediate.

1. Continuous Regulatory Monitoring and Proactive Compliance

The regulatory environment is in perpetual motion. A static approach to compliance is no longer viable. Institutions must:

- Leverage Regtech: Implement Regtech solutions for regulatory horizon scanning to automate the tracking of legislative shifts from the EU and national authorities.

- Develop Internal Expertise: Empower internal teams to interpret and disseminate regulatory intelligence across the organization.

- Engage with Rulemakers: Actively participate in industry consultations and forums to gain early insights and contribute to the rulemaking process.

- Embed a Compliance Culture: Foster a culture where adherence to the rules is a shared, organization-wide responsibility.

2. Agile Technological Investments in Fintech and Regtech

Strategic investment in technology is critical for competitiveness, efficiency, and resilience. This requires a balanced approach:

- Adopt Fintech and Regtech Strategically: Use Fintech to enhance products and client experience, and Regtech to manage risk and automate compliance. This includes targeted investments in AI, DLT, and cloud computing.

- Prioritize Cybersecurity and Resilience: Allocate significant resources to cybersecurity and ICT risk management to ensure full compliance with the stringent requirements of DORA.

- Modernize Legacy Systems: Undertake phased modernization programs to ensure new technologies can integrate effectively with existing infrastructure.

- Focus on Data Governance: Invest in robust data management and analytics, as high-quality data is the foundation for effective AI, personalization, and risk management.

3. Cultivating Specialized Legal and Regulatory Expertise

The complexity of the EU’s digital finance framework (MiCA, DORA, AI Act, etc.) necessitates access to specialized legal and regulatory expertise.

- Strengthen In-House Teams: Build internal legal and compliance teams with deep, current knowledge of EU financial law and how the various regulations interact.

- Engage External Counsel: Partner with specialist law firms and consultants with proven expertise in European Fintech and Regtech compliance.

- Manage Jurisdictional Nuances: Develop expertise to navigate the differences in how EU regulations are implemented at the national level.

4. Building an Innovation-Centric Governance Framework

To harness the opportunities of digital finance, institutions need a governance model that is both agile and robust.

- Ensure Board-Level Engagement: Secure active oversight from the board and senior management on the digital transformation strategy, its risks, and its opportunities.

- Define a Risk Appetite for Innovation: Establish a clear framework that allows for experimentation with new technologies and business models within acceptable boundaries.

- Foster Collaboration: Develop a strategy for partnering with Fintech startups, Regtech providers, and other ecosystem players to accelerate innovation.

- Invest in Talent: Implement training and upskilling programs to ensure employees can adapt to new technologies and digital processes.

Reduce your

compliance risks