Financial Crime Compliance: how to achieve it?

Financial crime compliance utilizes strategies to curb illicit finances. Key tactics include strict customer identification, transaction monitoring, risk assessment, and employing AI for fraud detection. Continual employee education and robust reporting systems are also crucial.

The global financial system is the engine of economic growth, but its vast network is also a prime target for criminal exploitation. For any financial institution, the foundational step toward safeguarding its integrity and fostering a secure global economy is to master the principles of Financial Crime Compliance (FCC). This involves a deep understanding of the sophisticated threats posed by modern financial crime and the critical importance of implementing a robust compliance framework to counter them.

Source

[1]

A Modern Taxonomy of Illicit Activities

Money Laundering

Money laundering is the process of concealing the illegal origin of funds to make them appear legitimate. This activity is a critical lifeline for organized crime, enabling criminals to use the profits from their illegal ventures. The Financial Crimes Enforcement Network (FinCEN) emphasizes that money laundering fuels the operations of drug traffickers, terrorists, and other criminal enterprises, causing severe societal harm. The process is typically broken down into three distinct stages:

- Placement: Introducing the illicit funds into the financial system.

- Layering: Executing complex financial transactions to obscure the audit trail and hide the source of the funds.

- Integration: Re-introducing the now-laundered money into the legitimate economy.

According to a 2009 estimate by the United Nations Office on Drugs and Crime (UNODC), laundered money accounted for approximately 2.7% of global GDP, equivalent to USD $1.6 trillion.

Terrorist Financing

This offense involves providing funds or financial support to terrorists or terrorist organizations. A key distinction from money laundering is that the funds for terrorist financing can originate from legal sources, such as salaries, business income, or charitable donations, but are intended for an illegal and violent purpose. The methodology often mirrors money laundering, involving stages of raising, moving, and using the funds. Disrupting the financial networks of terrorist groups is a central pillar of global counter-terrorism efforts and a key focus of Financial Crime Compliance.

Financial Fraud

Financial fraud is characterized by intentional acts of deception to achieve an unlawful gain. It is a wide-ranging category that includes:

- Identity Theft and Impersonation

- Creation of Falsified Business Records

- Misrepresentation of Goods or Services

The National Crime Victimization Survey defines it as an act that "intentionally and knowingly deceive the victim by misrepresenting, concealing, or omitting facts."

Bribery and Corruption

Corruption is the abuse of an entrusted position of power for private benefit. Bribery, the act of offering or receiving something of value to influence an official's actions—is a common form of corruption. These acts erode public trust, distort market competition, and create significant legal and reputational risks for institutions. Legislation like the U.S. Foreign Corrupt Practices Act (FCPA) has a broad definition of "government official," expanding its regulatory reach.

Sanctions Evasion

Sanctions evasion is the deliberate circumvention of international or national economic sanctions. These restrictive measures are imposed by bodies like the United Nations or individual governments (e.g., Canada's Special Economic Measures Act) to achieve foreign policy and national security objectives.

Market Abuse and Insider Dealing

Market abuse involves actions that unfairly manipulate financial markets or the use of non-public information for personal gain. Key forms include:

- Insider Dealing: Trading based on material, non-public information.

- Unlawful Disclosure: Illegally sharing such sensitive information.

- Market Manipulation: Artificially interfering with market prices or operations to create a false impression.

Such activities severely damage market integrity and undermine investor confidence.

Cybercrime

Cybercrime encompasses a wide range of financially motivated criminal activities that leverage digital technology. Perpetrators, often including organized crime groups and nation-states, employ methods such as:

- Ransomware Attacks: Holding data hostage in exchange for payment.

- Phishing: Deceiving victims into revealing sensitive financial information.

- Account Takeovers: Gaining unauthorized access to financial accounts.

The consequences can be devastating, leading to catastrophic financial losses for both individuals and businesses.

The Interconnected Nature of Financial Threats

The different types of financial crime are not isolated; they are highly interdependent. For instance, proceeds from fraud or bribery are often laundered. Cybercrime tools may be used to steal identities, which are then used to commit fraud or open accounts for terrorist financing. This interconnectedness means that a weakness in one area of a firm's defenses can be exploited by multiple types of criminals. Therefore, a successful Financial Crime Compliance program must be holistic, recognizing these links to build a comprehensive and resilient defense system.

Adapting to New Forms of Value: Digital Assets and Beyond

The definition of "value" in financial crime is constantly expanding beyond traditional currency and assets. The scope now includes digital assets like cryptocurrencies, which are explicitly targeted by criminals for their speed, perceived anonymity, and ease of cross-border transfer.

Regulatory bodies are adapting to this new reality. The Financial Action Task Force (FATF) is actively setting standards for activities involving virtual assets, such as its "Travel Rule" for Virtual Asset Service Providers (VASPs). Likewise, FinCEN has issued guidance on convertible virtual currencies. This dynamic landscape demands that Financial Crime Compliance programs remain agile, technologically aware, and committed to continuous education to manage the risks associated with these emerging forms of value.

Table 1: Overview of Key Financial Crime Typologies

| Crime Type | Core Definition | Common Examples/Mechanisms | Key Regulatory Focus/Legislation |

|---|---|---|---|

| Money Laundering | Concealing the illicit origins of money obtained from criminal activities. | Structuring transactions, use of shell companies, trade-based laundering, crypto mixing. | BSA (Bank Secrecy Act), EU AMLDs, POCA (Proceeds of Crime Act), FATF Recommendations |

| Terrorist Financing | Providing financial support to terrorists or terrorist organizations. | Use of legitimate businesses, NPOs, crowdfunding, hawala systems, virtual assets. | CTF laws, FATF Recommendations, UN Security Council Resolutions |

| Financial Fraud | Intentional deception for financial gain. | Identity theft, phishing, advance-fee scams, credit card fraud, accounting fraud. | Fraud Acts, BSA (SAR reporting), Criminal Codes |

| Bribery & Corruption | Abuse of power for personal gain, involving offering or receiving items of value to influence actions. | Kickbacks, facilitation payments, embezzlement by public officials. | FCPA (US), UK Bribery Act, UNCAC (UN Convention against Corruption) |

| Sanctions Evasion | Intentional circumvention of restrictive measures and international law. | Using front companies, obscuring ownership, transacting through non-sanctioned jurisdictions. | OFAC Regulations, EU/UN Sanctions Regulations |

| Market Abuse | Manipulating markets or using non-public information for personal financial benefit. | Insider dealing, market manipulation (spoofing, layering), unlawful disclosure. | MAR (EU), Securities Exchange Act (US) |

| Cybercrime (Financial) | Financially motivated criminal activity using digital means. | Ransomware, phishing, account takeovers, data breaches, malware, payment card skimming. | Computer Fraud Acts, Data Privacy Laws |

The Core Objectives of Financial Crime Compliance (FCC)

In the banking sector and beyond, Financial Crime Compliance (FCC) refers to the comprehensive suite of internal controls, policies, and systems designed to combat financial crime. It acts as an institution's primary defense, safeguarding its operations and upholding the integrity of the entire financial system. The objectives are not singular but multifaceted, aiming to create a resilient and secure environment.

The fundamental goals of any robust Financial Crime Compliance program are:

- Detection and Prevention: The primary objective is to create an operational environment that actively deters and prevents illicit activities. This proactive stance is more critical than simply reacting to crimes after they have occurred.

- Safeguarding System Integrity: FCC programs are vital for protecting national economies and the global financial system from the damaging effects of illicit funds. As FinCEN highlights, unchecked financial crime can erode the integrity of a nation's most critical financial institutions.

- Upholding Stakeholder Trust: By implementing strong defenses against financial crime, an institution maintains and strengthens the trust of its customers, investors, and the general public.

- Ensuring Regulatory Adherence: A core function is to guarantee strict adherence to all applicable laws and regulations, ensuring unethical practices are systematically identified and eliminated.

Key components of an effective FCC framework include rigorous Customer Due Diligence (CDD), ongoing transaction monitoring, screening against global watchlists (for sanctions and Politically Exposed Persons or PEPs), and comprehensive Know Your Customer (KYC) risk profiling.

From Reactive Measures to Proactive Deterrence

A crucial shift in perspective is understanding that Financial Crime Compliance must operate as a proactive deterrent, not just a reactive enforcement tool. The goal is to cultivate an environment where criminals are "less likely to try their illicit activities in the first place." This approach is much like how well-lit streets and visible policing deter street crime; visible and robust compliance controls deter financial criminals. This requires clear communication of compliance standards and the fostering of a strong ethical culture throughout the organization.

FCC as a Strategic Investment, Not a Cost Center

While the investment in a comprehensive FCC framework is significant, it is dwarfed by the potential losses from financial crime, regulatory fines, and catastrophic reputational damage. Viewing Financial Crime Compliance as a strategic investment in long-term resilience and trustworthiness—rather than a "check-the-box" cost center—is essential for sustainable success and security.

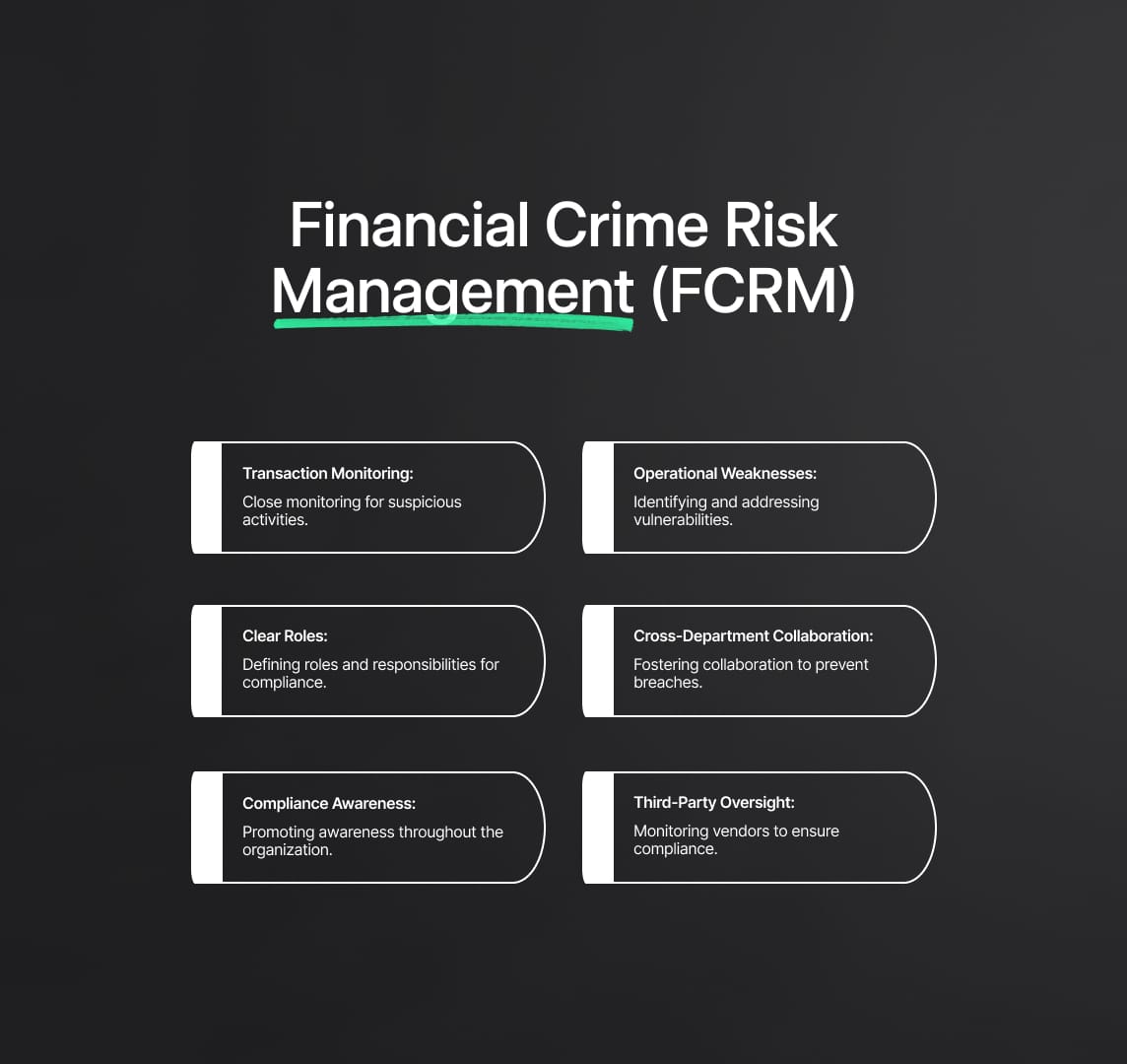

Implementing Strategy: The Financial Crime Risk Management (FCRM) Framework

The Financial Crime Risk Management (FCRM) framework is the operational arm of the broader FCC strategy. It is how compliance policies are implemented "on the ground," acting as the institution's first line of defense. FCRM translates strategy into practice through detailed risk assessments, the deployment of technology, and continuous training.

The Four Phases of Effective Risk Mitigation

The FCRM framework operates on a continuous, cyclical process to identify, understand, and mitigate risks.

1. Identification

This initial phase involves actively searching for anomalies and suspicious activities that signal potential financial crime. This could include:

- Transactions occurring at unusual times or in unusual patterns.

- Funds moving to or from high-risk jurisdictions.

- Customer behavior that deviates from their established profile.

The goal is to detect these red flags before they can escalate.

2. Assessment

Once a potential risk is identified, it must be evaluated for its potential impact and likelihood. This phase functions like a triage system, prioritizing the most critical threats to ensure that resources are allocated effectively.

3. Mitigation

Following assessment, the institution takes direct action to reduce the identified risk. This involves implementing specific controls, such as:

- Automating transaction monitoring systems to flag suspicious activity.

- Applying enhanced due diligence on high-risk customers or transactions.

- Blocking transactions linked to sanctioned entities.

These measures create barriers that make it harder for criminals to succeed.

4. Review

The financial crime landscape is constantly changing as criminals develop new schemes. Therefore, the FCRM cycle includes a critical review phase. Similar to updating a home security system to protect against new methods of entry, an institution must continuously update its controls and safety measures to remain effective.

A Dynamic and Adaptive Approach is Non-Negotiable

The cyclical nature of the FCRM framework, Identify, Assess, Mitigate, Review, is its greatest strength. A static, "set-it-and-forget-it" compliance program is doomed to fail, as criminals will always adapt their tactics to bypass outdated controls.

This reality necessitates a commitment to continuous learning, intelligence gathering on new crime typologies, and the agility to update compliance systems quickly. The feedback loop from incident analysis and Suspicious Activity Report (SAR) filings is invaluable in this process.

The Role of AI and Machine Learning in Modern FCRM

The need for adaptability highlights the growing importance of advanced technologies. Artificial Intelligence and Machine Learning (AI/ML) are becoming essential tools in modern Financial Crime Compliance. Unlike static, rule-based systems, AI/ML models can learn from new data in real-time, identify complex patterns, and adapt their detection mechanisms dynamically, providing a more resilient defense against sophisticated and evolving threats.

The Global and National Regulatory Maze in Financial Crime Compliance

The fight against financial crime is orchestrated by a complex web of international standards, national laws, and powerful regulatory bodies. For any institution, navigating this intricate maze is fundamental to building an effective Financial Crime Compliance program. A thorough understanding of the mandates from key authorities is not just a legal requirement—it is the bedrock of effective risk mitigation. This guide examines the pivotal global standard-setters, delves into the specific frameworks of major jurisdictions, and considers the influence of industry best-practice bodies.

The Financial Action Task Force (FATF): The Global Standard-Setter

Established in 1989 by the G7, the Financial Action Task Force (FATF) is the primary intergovernmental body that sets the global standards for Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT). Its mandate has grown from a narrow focus on drug money to a broad campaign against all forms of financial crime, including proliferation financing, cybercrime, and illicit use of virtual assets.

The FATF 40 Recommendations

The core of FATF's influence is its 40 Recommendations, which provide a complete framework for countries to protect the international financial system. They are designed with flexibility to adapt to different national legal systems and cover critical areas, including:

- Establishing national AML/CFT policies and coordination.

- Measures to combat money laundering and confiscate criminal proceeds.

- Strategies to counter terrorist and proliferation financing.

- Preventive measures for banks and Designated Non-Financial Businesses and Professions (DNFBPs).

- Requirements for transparency of beneficial ownership.

- Powers for Financial Intelligence Units (FIUs) and law enforcement.

- Mechanisms for international cooperation.

The Risk-Based Approach (RBA)

A foundational principle of the FATF standards is the Risk-Based Approach (RBA). This requires countries and financial institutions to identify, assess, and understand their specific money laundering and terrorist financing risks. In response, compliance measures must be applied that are proportionate to those risks, allowing for the efficient allocation of resources to the areas of greatest concern.

Ensuring Adherence: Mutual Evaluations and Public Listings

FATF enforces its standards through a global network of FATF-Style Regional Bodies (FSRBs). Together, they conduct periodic Mutual Evaluations of member countries to assess both technical compliance and practical effectiveness.

FATF also identifies nations with strategic deficiencies in their AML/CFT regimes.

- "Grey List" (Jurisdictions under Increased Monitoring): These countries are actively working with FATF to address their shortcomings.

- "Black List" (High-Risk Jurisdictions subject to a Call for Action): These countries are deemed to have significant strategic deficiencies, prompting global financial institutions to apply enhanced due diligence.

Evolving Focus Areas in Financial Crime Compliance

FATF constantly monitors and adapts to emerging threats. Key modern focus areas include:

- Beneficial Ownership Transparency: FATF requires countries to ensure that accurate information on the true owners of companies and trusts is available to authorities, with updated guidance issued in March 2023 and March 2024.

- Virtual Assets: FATF has issued specific guidance for Virtual Asset Service Providers (VASPs), including the "Travel Rule," which mandates that VASPs collect and transmit originator and beneficiary information during transfers, mirroring traditional wire transfer rules.

FATF's Influence: The Impact of "Soft Power"

While FATF has no direct enforcement or sanctioning power, its influence is immense. This "soft power" stems from peer pressure and the severe economic and reputational consequences of being placed on a public list. The risk of being labeled a high-risk jurisdiction—and the subsequent de-risking by global banks—is a powerful incentive for countries to adopt and implement FATF standards, making its publications essential reading for any Financial Crime Compliance professional.

United States Regulatory Framework

The U.S. framework is one of the world's most established, anchored by the Bank Secrecy Act and significantly enhanced by the USA PATRIOT Act.

Bank Secrecy Act (BSA) (1970)

The BSA was the foundational U.S. law for preventing money laundering. It mandates that financial institutions keep records and file reports useful for criminal, tax, and regulatory investigations. Key requirements include:

- Recordkeeping: Maintaining records of cash purchases of negotiable instruments.

- Currency Transaction Reports (CTRs): Filing reports for cash transactions exceeding $10,000 in a single day.

- Suspicious Activity Reports (SARs): Reporting suspicious activities that may indicate money laundering, tax evasion, or other crimes.

USA PATRIOT Act (2001)

Enacted after the 9/11 attacks, Title III of this Act dramatically strengthened U.S. AML/CFT laws. Key provisions impacting Financial Crime Compliance include:

- Section 311: Authorizes the Treasury to designate foreign jurisdictions or institutions as a "primary money laundering concern" and impose special measures.

- Section 312: Mandates special due diligence for correspondent accounts for foreign banks and private banking accounts for non-U.S. persons.

- Section 313: Prohibits U.S. banks from providing correspondent accounts to foreign shell banks.

- Section 326: Requires formal Customer Identification Programs (CIPs) to verify the identity of customers opening new accounts.

- Section 352: Mandates comprehensive AML programs with four pillars: (1) internal controls, (2) a designated compliance officer, (3) ongoing employee training, and (4) an independent audit function.

Financial Crimes Enforcement Network (FinCEN)

FinCEN is a bureau of the U.S. Treasury and serves as the nation's Financial Intelligence Unit (FIU). It administers the BSA and its mission is to safeguard the financial system from illicit use. Its core functions are to:

- Issue regulations and guidance on the BSA.

- Collect and analyze BSA data to identify trends and threats.

- Provide intelligence to law enforcement agencies.

- Take enforcement actions against institutions for BSA violations.

European Union (EU) Regulatory Framework

The EU employs a harmonized AML/CFT framework through a series of Anti-Money Laundering Directives (AMLDs), which member states must transpose into national law.

The Evolution of the AMLDs

The EU framework has evolved iteratively, with each directive expanding its scope and strengthening its requirements in line with FATF standards and emerging risks.

- 4th AMLD (2017): Emphasized a risk-based approach and introduced central registers of beneficial ownership.

- 5th AMLD (2020): Brought virtual currency platforms and custodian wallet providers under AML/CFT rules and enhanced transparency around beneficial ownership.

- 6th AMLD (2021): Focused on harmonizing the definition of money laundering across the EU, creating a unified list of 22 predicate offenses (including cybercrime and environmental crime), and extending criminal liability to companies, not just individuals.

This clear pattern of continuous enhancement signals that Financial Crime Compliance in the EU is a process of constant adaptation, requiring firms to maintain agile programs capable of responding to new legislation.

United Kingdom (UK) Regulatory Framework

The UK has a formidable legal framework, led by the Proceeds of Crime Act 2002 (POCA) and the Financial Conduct Authority (FCA).

Proceeds of Crime Act 2002 (POCA)

POCA is the primary UK legislation for asset recovery and criminalizing money laundering. Its scope is exceptionally broad, focusing on denying criminals the benefit of their conduct. Key powers under POCA include:

- Confiscation Orders: Recovering a defendant's benefit from a "criminal lifestyle" after conviction.

- Civil Recovery: Recovering criminal property without a criminal conviction.

- Cash Seizure and Forfeiture: Seizing cash suspected to be from or for unlawful conduct.

- Investigative Powers: Granting powers for search warrants, production orders, and asset freezes.

The main money laundering offenses under POCA are found in Sections 327, 328, and 329, which cover concealing, arranging, and acquiring criminal property.

Financial Conduct Authority (FCA)

The FCA is the key UK regulator for preventing financial crime in supervised firms. It sets rules, provides guidance, and takes enforcement action for breaches. Recent FCA enforcement has focused on weaknesses in:

- Sanctions compliance mechanisms.

- Automated transaction monitoring systems.

- Customer-specific risk assessments and due diligence.

The Wolfsberg Group: Guiding Industry Best Practices

The Wolfsberg Group is an association of thirteen global banks that develops influential, non-binding guidance for managing financial crime risks. Regulators often reference its publications as a benchmark for good practice. Key focus areas include:

- Correspondent Banking: Known for its Correspondent Banking Due Diligence Questionnaire (CBDDQ).

- Risk-Based Approach (RBA): Strong advocacy for assessing country, customer, and services risk.

- CDD and PEPs: Detailed guidance on Enhanced Due Diligence (EDD) for high-risk customers.

- Emerging Topics: Publications on payment transparency, trade finance, sanctions screening, and the use of AI/ML in Financial Crime Compliance.

The Wolfsberg Group acts as a crucial bridge, translating high-level regulatory principles into practical, actionable standards for financial institutions worldwide.

Table 2: Major Global and Regional FCC Regulatory Frameworks & Bodies

| Framework/Body | Type | Key Mandate/Provisions | Primary Focus Areas |

|---|---|---|---|

| FATF | Global Standard Setter | 40 Recommendations, Risk-Based Approach, Mutual Evaluations, High-Risk Jurisdiction Listing, Beneficial Ownership, Virtual Assets (Travel Rule). | AML, CTF, Proliferation Financing, Global Standards |

| US Bank Secrecy Act (BSA) | US Legislation | Recordkeeping, CTRs (> $10k), SARs. | AML, CTF, Tax Evasion |

| US USA PATRIOT Act | US Legislation | Enhanced AML/CTF: Sec 311 (Special Measures), Sec 312 (Correspondent/Private Banking DD), Sec 313 (Shell Banks), Sec 326 (CIP), Sec 352 (AML Programs). | AML, CTF, National Security |

| US FinCEN | US Agency (FIU) | Administers BSA, issues regulations/guidance, collects/analyzes BSA data, supports law enforcement, focuses on BOI & digital assets. | AML, CTF, Financial Intelligence |

| EU AMLD Series (4th–6th) | EU Directive Series | Harmonized EU rules: RBA, UBO registries, VASP regulation (5AMLD), predicate offense harmonization, legal person liability (6AMLD). | AML, CTF (EU-wide consistency) |

| UK POCA 2002 | UK Legislation | Asset recovery (confiscation, civil recovery), ML offenses (concealing, arranging, acquiring criminal property). | Asset Recovery, Money Laundering |

| UK FCA | UK Regulator | Supervises firms' financial crime systems/controls, enforcement actions for AML/sanctions failings. | Financial Crime Prevention, Market Integrity |

| Wolfsberg Group | Industry Body (Global Banks) | Develops best practice guidance: CBDDQ, RBA, PEPs, Sanctions Screening, Payment Transparency, AI in FCC. | AML, CTF, KYC, Correspondent Banking (Best Practices) |

Building a Robust Financial Crime Compliance Program

Transitioning from regulatory knowledge to practical application, building an effective Financial Crime Compliance (FCC) program requires a dynamic, integrated system. It is not merely a collection of policies but a living framework built on strong governance, diligent risk assessment, comprehensive customer lifecycle management, and vigilant reporting mechanisms.

Governance: The Three Lines of Defense (3LoD) Model

Effective governance is the absolute cornerstone of a successful FCC program. The Three Lines of Defense (3LoD) model is the industry-standard framework for clarifying roles, responsibilities, and accountability for risk management across an organization.

The First Line: Operational Management and Risk Ownership

The first line consists of the business units and front-line staff directly involved in day-to-day operations. They are the initial barrier against financial crime. Their primary responsibilities include:

- Owning and managing the financial crime risks associated with their specific products, services, and customer interactions.

- Executing risk and control procedures as part of their daily activities.

- Identifying and assessing emerging risks within their business domain.

- Applying internal controls that align with the institution's overall compliance objectives.

The Second Line: Risk Management and Compliance Oversight

The second line is comprised of the dedicated risk management and Financial Crime Compliance functions. It provides independent oversight and expertise to the first line. Its key responsibilities are:

- Establishing policies, frameworks, and standards for risk management.

- Monitoring and challenging the effectiveness of the first line's controls.

- Ensuring that all activities adhere to regulatory standards.

- Proactively testing and monitoring high-risk business areas.

- Reporting on risk and compliance matters to senior management and the board.

The Third Line: Independent Assurance through Internal Audit

The third line is the internal audit function, which provides the highest level of independent and objective assurance. Its organizational independence is its key attribute. The third line's primary role is to:

- Independently validate that the first and second lines' risk management efforts are designed effectively and operating as intended.

- Evaluate and improve the effectiveness of the organization's overall risk management, control, and governance processes.

- Provide objective assurance and recommendations directly to senior management and the board.

The Crucial Role of Board and Management Oversight

Ultimate responsibility for an institution's Financial Crime Compliance rests at the very top. The board of directors and senior management must set a clear "culture of compliance." This oversight requires:

- Approving the institution's official BSA/AML compliance program.

- Overseeing the structure and management of the entire compliance function.

- Receiving regular, comprehensive reports on SAR filings, audit findings, risk assessment changes, and the adequacy of compliance resources.

Making the 3LoD Model Work: The Importance of Independence

The 3LoD model's effectiveness collapses without a clear demarcation of roles and true independence between the lines. As seen in regulatory enforcement actions, failures like "limited documentation clarifying roles and responsibilities" can lead directly to control weaknesses and significant breaches. A strong governance structure is the most critical defense against systemic FCC failures.

The Enterprise-Wide Risk Assessment (EWRA): A Foundational Process

The Enterprise-Wide Risk Assessment (EWRA) is the strategic foundation of any modern, risk-based Financial Crime Compliance program. It is a comprehensive process to systematically identify, assess, and understand the full range of ML/TF and other financial crime risks across all business lines, products, customers, and geographies. The EWRA informs the institution's risk appetite and is the blueprint for its entire risk-based approach.

Auditors and regulators, guided by FATF standards, expect institutions to conduct a thorough EWRA, often annually. This assessment should be informed by relevant National Risk Assessments (NRAs) and typically covers AML/CFT, sanctions, proliferation financing, and anti-bribery and corruption risks.

A Structured Approach to the EWRA Process

A robust EWRA process can be structured into three main stages.

Stage 1: Identify Scope, Context, and Criteria

This initial stage involves defining the assessment's boundaries (e.g., legal entities, regions) and establishing clear, consistent criteria, including the risk assessment methodology, scoring matrix, and weighting factors.

Stage 2: Risk Assessment (Identify, Analyze, Evaluate)

This is the core of the EWRA, involving several key steps:

- Risk Identification: Systematically identifying potential financial crime risks by considering factors like customer base (PEPs, high-risk clients), geographic exposure, products (anonymity, cross-border speed), and delivery channels (non-face-to-face).

- Risk Analysis: Analyzing the likelihood and potential impact (financial, regulatory, reputational) of each identified risk.

- Risk Evaluation: Comparing the analysis against the institution's risk appetite. This step distinguishes between:

- Inherent Risk: The level of risk before controls are applied.

- Control Effectiveness: The strength of the existing mitigation measures.

- Residual Risk: The level of risk that remains after controls are applied.

Stage 3: Risk Treatment

Based on the evaluation of residual risk, the institution decides on a course of action for each risk. The primary options are:

- Accept: If the risk is within the defined risk appetite.

- Monitor: For risks that are currently acceptable but could change.

- Mitigate: By implementing new or enhanced controls to reduce the risk.

- Avoid: By exiting a product line, market, or customer relationship if the risk is unacceptably high.

Common Challenges in Conducting a Robust EWRA

Institutions face numerous hurdles in executing an effective EWRA, including:

- Securing adequate resources and expertise.

- Managing organizational complexity.

- Keeping pace with evolving threats and regulations.

- Ensuring data quality and availability.

- Integrating the EWRA with other risk frameworks.

- Fostering a strong, firm-wide risk culture.

The EWRA as a "Living Document": Beyond the Annual Exercise

Crucially, the EWRA must be treated as a dynamic, "living document," not a static, check-the-box annual exercise. The financial crime landscape changes constantly. An effective EWRA is an ongoing process, regularly reviewed and updated to reflect new threats, products, and regulatory expectations. It should be embedded into the institution's strategic planning cycle, serving as a critical tool for proactive risk management that informs resource allocation, technology investment, and overall business strategy.

Customer Due Diligence (CDD): The Foundation of KYC

Customer Due Diligence (CDD) is the foundational process in any Financial Crime Compliance program. It is the mechanism by which institutions understand who their customers are and the financial crime risks they pose. As an integral part of Know Your Customer (KYC) requirements, the CDD process protects institutions from criminal exploitation, regulatory penalties, and reputational harm by ensuring they are doing business with verified and trustworthy individuals and entities.

The Four Core Steps of the CDD Process

The CDD process is a multi-stage lifecycle, not a one-time check.

1. Identification

This initial step involves gathering essential identifying information.

- For Individuals: Full legal name, residential address, date of birth, and nationality.

- For Corporate Entities: Legal name, registered address, legal form, details on the nature of the business, and information on directors and individuals with significant control.

2. Verification

The institution must then take reasonable steps to verify this information using reliable, independent source documents or data.

- For Individuals: Examining government-issued photo IDs (passports, driver's licenses) and proof of address (utility bills).

- For Corporate Entities: Reviewing incorporation documents, partnership agreements, and public registry data. A critical element is identifying and verifying the Ultimate Beneficial Owners (UBOs)—the real people who ultimately own or control the entity.

3. Risk Assessment

Based on the verified information, the institution assesses the potential Money Laundering/Terrorist Financing (ML/TF) risk. This considers factors like the customer's location, business nature, intended products, and source of funds. Customers are then categorized into risk levels (e.g., low, standard, high), which dictates the level of ongoing scrutiny required.

4. Ongoing Monitoring

CDD is continuous. Institutions must monitor business relationships and transactions to ensure they remain consistent with the customer's known risk profile. This includes keeping customer information up-to-date and detecting suspicious activity that may warrant investigation.

CDD: The Gateway to an Effective Risk-Based Approach

An accurate and thorough CDD process is fundamental. Misclassifying a high-risk customer as standard-risk creates a significant vulnerability. Conversely, misclassifying a low-risk customer can create unnecessary friction and misallocate compliance resources. Deficiencies in CDD are a recurrent theme in regulatory enforcement actions, highlighting its critical importance to the entire Financial Crime Compliance framework.

Enhanced Due Diligence (EDD): Managing High-Risk Relationships

When a customer is identified as posing a higher risk of involvement in financial crime, Enhanced Due Diligence (EDD) is required. EDD is a more stringent and investigative process triggered by high-risk flags, such as dealings with Politically Exposed Persons (PEPs), customers in high-risk jurisdictions, or those in high-risk industries.

Key Elements of an Enhanced Due Diligence Investigation

EDD involves a much deeper level of scrutiny than standard CDD. Key components include:

- Obtaining Additional Information: Using detailed questionnaires and requesting more extensive documentation (e.g., articles of incorporation, details of banking relationships, comprehensive identity of all board members).

- Establishing Source of Wealth (SoW) and Source of Funds (SoF): This is a critical step. The institution must verify the origin of a customer's total wealth (SoW) and the origin of the specific funds being used (SoF) to ensure their legitimacy.

- Scrutinizing the Business Relationship: Conducting an in-depth analysis of the intended nature and purpose of the relationship and the expected pattern of transactions.

- Enhanced Transaction Monitoring: Applying more intensive and frequent monitoring with lower alert thresholds and more complex rules.

- Adverse Media and Negative News Screening: Performing comprehensive searches of the customer and their associates against news reports and databases to identify any links to illicit activities.

- Obtaining Senior Management Approval: Requiring approval from senior management to establish or continue any high-risk business relationship.

- More Frequent CDD Reviews: Updating customer information and risk assessments on a more frequent basis than for standard-risk clients.

Why EDD is More Than Just "More CDD"

EDD is a qualitatively different level of investigation. It requires more sophisticated investigative skills, access to a wider array of information sources, and a more critical and analytical mindset. It is about constructing a comprehensive narrative of the customer's "story" and the provenance of their money, not just collecting documents.

Screening and Monitoring Politically Exposed Persons (PEPs)

Politically Exposed Persons (PEPs) are individuals entrusted with prominent public functions who are deemed higher risk for potential involvement in bribery and corruption. Adequately managing PEP relationships is a critical component of any Financial Crime Compliance program.

The PEP Screening and Management Lifecycle

- Data Collection: At onboarding, collect key data points including the customer's full name, aliases, date of birth, country of political activity, and specific public office held.

- Screening Against Databases: Cross-reference customer information against various sources, including regulatory lists, commercial PEP databases, and open-source intelligence (OSINT) from media archives.

- Risk Assessment: If a potential PEP is identified, conduct a detailed risk assessment considering their role and influence, the corruption level of their country, their sectoral exposure, and information on their relatives and close associates (RCAs).

- Application of EDD: If confirmed as a PEP, apply full Enhanced Due Diligence measures, including establishing SoW/SoF and obtaining senior management approval.

- Onboarding Decision: Based on the EDD, make a documented decision to onboard the PEP (potentially with limits) or deny the relationship if the risks are too high.

- Ongoing Monitoring: Continuously monitor the PEP's transactions, re-screen against updated lists, and reassess their risk profile if their status changes.

A Risk-Based Approach to Former PEPs

The question of "once a PEP, always a PEP?" is a significant challenge. A modern, risk-based approach is required. This involves considering the time elapsed since the individual left office, the seniority of their former position, and any subsequent adverse information to determine if and when the level of scrutiny can be adjusted, a process that must be based on a clear, documented policy.

Transaction Monitoring (TM): Detecting Suspicious Activity

Transaction Monitoring (TM) is the operational core of detection within a Financial Crime Compliance program. It involves the continuous scrutiny of customer transactions to identify patterns, anomalies, and behaviors that may indicate financial crime.

The AML Transaction Monitoring Process

- Data Ingestion and Analysis: TM systems ingest vast quantities of transaction data.

- Rule and Scenario Application: The data is analyzed against predefined rules and behavioral models to identify activity that deviates from a customer's established profile or matches known ML typologies.

- Alert Generation: When a transaction matches a rule, an alert is generated for review.

- Alert Investigation and Disposition: An analyst investigates the alert. If a legitimate explanation is found, it is closed with a documented rationale. If it remains suspicious, it is escalated for a potential Suspicious Activity Report (SAR) filing.

Key Technologies in Modern Transaction Monitoring

- Rule-Based Systems: Traditional systems using predefined rules and thresholds.

- Statistical and Behavioral Analytics: Systems that establish a baseline of "normal" behavior and flag significant deviations.

- Artificial Intelligence (AI) and Machine Learning (ML): Advanced algorithms that learn from data to identify complex patterns, adapt to new threats, and significantly reduce false positives.

- Network and Graph Analytics: Tools that visualize connections between accounts and transactions to uncover hidden criminal networks.

Common Red Flags Detected by Transaction Monitoring

- Unusual transaction volume, value, or frequency.

- Structuring transactions to avoid reporting thresholds (e.g., multiple deposits just under $10,000).

- Transactions inconsistent with the customer's known business activities.

- Rapid movement of funds between jurisdictions with no clear economic purpose (layering).

- Transactions involving high-risk jurisdictions or sanctioned parties.

- Complex transaction structures designed to obscure the source of funds.

The Challenge of False Positives and the Importance of Data Quality

A major challenge in TM is the high volume of "false positive" alerts, which can overwhelm compliance teams. The drive to reduce false positives is a key factor motivating the adoption of AI and ML. However, the effectiveness of any TM system depends entirely on the quality of the data it receives. As highlighted in regulatory actions, "bad data" or incomplete data can lead to entire transaction streams being unmonitored, creating massive compliance vulnerabilities.

The Suspicious Activity Report (SAR): Reporting and Best Practices

The Suspicious Activity Report (SAR) is a cornerstone of an effective Financial Crime Compliance program. It is the official mechanism for a financial institution to report known or suspected violations of law to the appropriate authorities, as mandated by laws like the U.S. Bank Secrecy Act (BSA). SARs serve a dual purpose: they provide law enforcement with actionable intelligence for investigations and supply financial intelligence units like FinCEN with vital data to identify emerging crime trends.

Key SAR Filing Requirements (U.S. FinCEN Context)

- Timeliness: A SAR must be filed no later than 30 calendar days after the date of initial detection. If a suspect has not been identified, this can be extended by another 30 days, but the filing cannot be delayed more than 60 calendar days from the initial detection.

- Filing System: SARs are filed electronically via FinCEN's BSA E-Filing System. It is recommended to complete the form offline to avoid system timeouts before uploading for submission.

How to Write an Effective SAR Narrative

The narrative is the most important part of the SAR. It is where you tell the story and explain exactly why the activity is suspicious. A well-written narrative is concise, accurate, and organized. FinCEN suggests a clear three-part structure to ensure all necessary information is included.

Part 1: The Introduction

Start with a clear summary of the report.

- State the purpose of the SAR and provide a general description of the suspected violation (e.g., structuring, potential terrorist financing, embezzlement).

- Reference any previously filed SARs on the same subject, including dates and document control numbers.

- Note if the activity involves OFAC-sanctioned parties or countries.

- Include any internal investigation numbers for your institution's reference.

Part 2: The Body (The "Five W's and How")

This section should contain all the chronological facts and details of the suspicious activity, comprehensively answering the following questions:

Who is conducting the suspicious activity?

- Provide full details of all suspects: names, addresses, dates of birth, occupations, and relationships between them.

- Include all known identification numbers (TIN, passport, driver's license).

What instruments or mechanisms are being used?

- Describe the financial instruments (e.g., wire transfers, virtual currency, shell companies).

- Detail the methods used (e.g., internet banking, ATM, phone).

- Identify the source of funds (origination) and the use of funds (beneficiary).

- List all affected account numbers at your institution and any others involved.

When did the suspicious activity take place?

- Specify the date the activity was first noticed and the total duration.

- Provide a chronological list of individual transaction dates and amounts, not just aggregated totals.

Where did the suspicious activity take place?

- Name all branches or offices of your institution that were involved.

- If foreign jurisdictions are involved, provide the country, financial institution names, addresses, and relevant account numbers.

Why does the filer believe the activity is suspicious?

- Explain why the activity is unusual for this specific customer, considering their known profile, business type, and normal transaction patterns.

- Describe any specific "red flags" observed, such as structuring to avoid reporting thresholds, activity inconsistent with their stated business, or unexplained transfers to high-risk jurisdictions.

How did the suspicious activity occur?

- Describe the "modus operandi" or method used.

- Provide a logical, step-by-step description of the entire scheme from start to finish.

Part 3: The Conclusion

Summarize the report and outline next steps.

- Detail any follow-up actions your institution has taken or intends to take (e.g., account closure, enhanced ongoing monitoring).

- Provide contact information for personnel who can assist with further inquiries.

- List any law enforcement personnel who have already been contacted about the matter.

Critical "Do Nots" for SAR Filing

To ensure the SAR is processed correctly, follow these technical guidelines:

- Do Not Attach Supporting Documentation: All supporting documents must be kept on file for five years and provided to law enforcement upon request. Do not use phrases like "see attached" in the narrative; instead, describe the documents you have available.

- Avoid Objects and Tables: Do not insert tables, objects, or spreadsheets into the narrative field. Describe or summarize the data in plain text.

The SAR Narrative as a Critical Intelligence Tool

While the structured data fields of a SAR are important, the narrative provides the essential context. A well-crafted narrative allows an investigator to quickly grasp the situation, connect it to other intelligence, and prioritize resources. Poorly written narratives can impede investigations and allow serious crimes to go unaddressed. Investing in training staff to write clear, concise, and comprehensive narratives is a direct reflection of an institution's commitment to its Financial Crime Compliance duties and the global fight against financial crime.

The Role of the Nationwide SAR Initiative (NSI)

In the U.S., the Nationwide SAR Initiative (NSI) is a collaborative effort between federal, state, and local law enforcement. It establishes a national capacity for gathering, analyzing, and sharing SAR intelligence to help prevent terrorism and other major crimes, ensuring that the information provided in SARs is effectively utilized.

Table 3: Core Components of an Effective FCC Program

| Component | Objective | Key Activities/Considerations | Relevant Regulatory/Guidance Link |

|---|---|---|---|

| Governance (3LoD) | Establish clear roles, responsibilities, and oversight for managing financial crime risk. | Define 1st, 2nd, 3rd line duties; ensure Board/Senior Management oversight & “tone from the top”; maintain independence of 2nd/3rd lines. | Board Oversight |

| Enterprise-Wide Risk Assessment (EWRA) | Identify, assess, and understand the institution’s overall financial crime risk profile. | Conduct periodically; cover products, services, customers, geographies; inform Risk-Based Approach; document methodology, inherent/residual risks, controls. | FATF Rec 1 |

| Customer Due Diligence (CDD) | Know your customers, verify their identities, and assess their initial risk. | Collect/verify identity info (including UBOs); assess risk based on profile/behavior; conduct ongoing monitoring. | FATF Rec 10 |

| Enhanced Due Diligence (EDD) | Apply heightened scrutiny to high-risk customers to better understand and mitigate risks. | Obtain additional info; establish/verify Source of Wealth/Funds; conduct deeper transaction analysis; adverse media checks. | FATF Rec 10 |

| PEP Screening & Monitoring | Identify and manage risks associated with Politically Exposed Persons. | Screen against PEP lists; conduct EDD for PEPs; monitor relationships and transactions; obtain senior management approval. | FATF Rec 12 |

| Transaction Monitoring (TM) | Detect unusual or suspicious transactions inconsistent with customer profiles or known typologies. | Implement risk-based rules/scenarios; investigate alerts; utilize technology (AI/ML) to reduce false positives and improve detection; ensure data quality. | FATF Rec 10 |

| Suspicious Activity Reporting (SAR) | Report known or suspected illicit activities to authorities in a timely and comprehensive manner. | Train staff on SAR requirements; ensure complete and accurate narratives (5 W’s & How); file within regulatory deadlines; maintain supporting documentation. | BSA; FATF Rec 20 |

| Employee Training | Ensure staff understand their FCC obligations, can identify red flags, and know procedures. | Conduct regular, role-specific training; cover policies, regulations, typologies, SAR filing; test understanding; maintain records. | USA PATRIOT Act Sec 352 |

| Independent Audit/Testing | Assess the adequacy and effectiveness of the FCC program independently. | Conduct periodic testing (internal or external); review policies, procedures, controls, execution; report findings to Board/Senior Management; track remediation. | USA PATRIOT Act Sec 352 |

IV. Leveraging Technology for Enhanced Financial Crime Compliance

The landscape of Financial Crime Compliance (FCC) is being profoundly reshaped by technology. As criminals adopt more sophisticated methods and transaction volumes surge, traditional manual processes are no longer adequate. Technology enhances detection, improves efficiency, and enables a more proactive approach to managing financial crime risk. This section explores the impact of Regulatory Technology (RegTech), the applications of Artificial Intelligence (AI), and the specific challenges posed by digital assets.

The Rise of RegTech: Transforming Compliance Efficiency

Regulatory Technology (RegTech) is the application of innovative technology to help financial institutions meet their compliance obligations more effectively and efficiently. Spurred by the increasing regulatory complexity since the 2008 financial crisis, RegTech is fundamentally changing how compliance is managed.

Key Features of RegTech Solutions

- Automation: Automating repetitive tasks like data collection, customer screening, and regulatory reporting to reduce manual workload and human error.

- Real-Time Monitoring: Providing near real-time oversight of transactions, enabling prompt detection and response to suspicious activity.

- Data Analytics: Employing advanced analytics to process large datasets, identify trends, patterns of risk, and compliance gaps.

- Regulatory Reporting: Streamlining and automating the generation and submission of reports to regulators, improving accuracy and timeliness.

- Risk Management: Offering dynamic tools for more comprehensive assessment and mitigation of compliance risks.

The Impact of RegTech on Financial Crime Compliance

- Streamlined Processes: By automating routine tasks, RegTech frees up compliance professionals to focus on complex investigations and strategic analysis.

- Cost Reduction: Increasing efficiency and reducing manual errors leads to significant operational cost savings and helps avoid substantial regulatory fines.

- Improved Accuracy and Data Quality: Advanced analytics and data validation features enhance the integrity of compliance data, leading to more reliable reporting and decision-making.

The Strategic Value of RegTech: Beyond Cost-Saving

While efficiency is a key driver, the true potential of RegTech lies in enabling a more intelligent compliance function. It empowers skilled professionals to shift from reactive, process-driven work to proactive, strategic risk management. Financial institutions should view RegTech not as a cost-saving tool, but as a strategic investment to enhance the overall intelligence and effectiveness of their Financial Crime Compliance programs.

Compliance in the Digital Age: Cryptocurrencies and Virtual Assets

The rise of cryptocurrencies and other virtual assets has introduced new and complex challenges for FCC. Their perceived anonymity, speed, and decentralized nature have made them attractive for illicit use, leading to intense global regulatory scrutiny.

The U.S. Regulatory Landscape for Digital Assets

Regulation in the U.S. is handled by multiple agencies, including FinCEN (AML/CFT), the SEC (for assets deemed securities), and the CFTC (for assets deemed commodities).

Key Compliance Obligations for U.S. Virtual Asset Service Providers (VASPs)

Entities administering or exchanging virtual currencies are generally considered Money Services Businesses (MSBs) under the Bank Secrecy Act (BSA) and must adhere to strict requirements:

- MSB Registration: Register with FinCEN.

- AML Program: Implement a full, risk-based AML program, including policies, a compliance officer, training, and independent testing.

- Recordkeeping and Reporting: File SARs for suspicious transactions valued at $2,000 or more.

- "Travel Rule" Compliance: Collect and transmit required information on fund transfers over $3,000, including those involving virtual currencies.

- Customer Due Diligence (CDD): Implement a full CDD program to identify and verify customers and their beneficial owners.

International Standards: The Role of FATF and the EU

- Financial Action Task Force (FATF): The global standard-setter has mandated the "Travel Rule" for VASPs worldwide (Recommendation 16), requiring the exchange of originator and beneficiary information on virtual asset transfers.

- European Union: The 5th Anti-Money Laundering Directive (5AMLD) brought VASPs under AML/CFT regulation, and the subsequent Markets in Crypto-Assets Regulation (MiCA) establishes a comprehensive framework for the entire EU.

The Guiding Principle: "Same Risk, Same Regulation"

The global regulatory direction is clear: while the technology is new, the financial crime risks are analogous to those in traditional finance. Regulators are adapting existing frameworks to ensure VASPs face comparable compliance obligations. The era of light-touch regulation for digital assets is over, and proactive investment in sophisticated compliance infrastructure, including specialized blockchain analytics tools, is now essential for any firm operating in this space.

Table 5: Key Technologies in Financial Crime Compliance

| Technology Category | Specific Application in FCC | Key Benefits | Key Challenges/Considerations |

|---|---|---|---|

| RegTech Platforms | Automation of KYC/CDD, transaction monitoring, regulatory reporting, case management, risk assessment. | Efficiency, cost reduction, improved accuracy, consistency, streamlined workflows, centralized data. | Integration with legacy systems, cost of adoption, vendor risk management, ensuring scalability and flexibility. |

| Artificial Intelligence / Machine Learning (AI/ML) | Advanced transaction monitoring, false positive reduction, predictive risk scoring, behavioral analytics, automating CDD/KYC checks, fraud detection. | Enhanced detection of complex patterns, adaptability to new threats, significant reduction in false positives, improved operational efficiency. | Data quality and bias, model explainability (XAI), “black box” concerns, need for specialized expertise, high implementation costs, model drift. |

| Blockchain Analytics & Crypto Forensics | Tracing cryptocurrency transactions, identifying links to illicit activities (e.g., darknet markets, ransomware), VASP risk assessment, Travel Rule compliance. | Enhanced transparency for on-chain transactions, identification of high-risk crypto entities/wallets, support for investigations. | Privacy concerns with deanonymization, evolving criminal tactics (mixers, privacy coins), cross-chain complexity, cost of tools and expertise. |

| Data Aggregation & Advanced Analytics Tools | Consolidating data from disparate internal/external sources, creating a single customer view, network analysis, identifying hidden relationships. | Holistic risk assessment, improved understanding of customer behavior, enhanced detection of sophisticated schemes. | Data quality and standardization issues, integration challenges, data privacy regulations (e.g., GDPR), analytical skill gap. |

| Secure Communication & Information Sharing Platforms | Facilitating secure information exchange between FIs (private-to-private) and between FIs and authorities (public-to-private). | Improved collective ability to detect and prevent financial crime, faster response to emerging threats, breaking down intelligence silos. | Legal and data privacy restrictions on sharing, establishing trust and common standards, interoperability of platforms, potential for data leakage. |

| Digital Identity (Digital ID) & Biometrics | Secure and efficient customer identification and verification during onboarding and ongoing authentication (FATF Guidance). | Reduced onboarding friction, enhanced security against impersonation fraud, improved data accuracy. | Technology maturity and standardization, interoperability, data privacy and security of biometric data, accessibility for all customer segments. |

V. Ensuring Effectiveness: Measurement, Enforcement, and Learning

Implementing a Financial Crime Compliance (FCC) program is only the beginning; ensuring its ongoing effectiveness is a continuous and critical challenge. A successful framework requires robust measurement, a keen understanding of regulatory enforcement trends, and a commitment to learning from both internal and external events. This section focuses on how institutions can measure the efficacy of their compliance efforts to build a truly resilient program.

Measuring Compliance Program Effectiveness: Key Metrics and KPIs

Measuring the effectiveness of an FCC program is essential for preventing legal, financial, and reputational harm. A well-structured measurement framework, using both quantitative and qualitative Key Performance Indicators (KPIs), allows an institution to assess its adherence to regulations, evaluate internal policies, and gauge how well a culture of compliance is being embedded within the organization.

Quantitative Metrics: Data-Driven Insights

Quantitative metrics provide objective, numerical data on the performance of the FCC program. Key examples include:

- Training and Awareness:

- Compliance training completion rates (% of employees).

- Incident Management:

- Number of compliance incidents reported.

- Mean Time to Issue Discovery (MTTD).

- Mean Time to Issue Resolution (MTTR).

- Audit and Risk Assessment:

- Number of audit findings and the rate of timely corrective actions.

- Changes in residual risk scores from EWRAs.

- Regulatory Responsiveness:

- Time taken to identify, analyze, and implement changes following regulatory updates.

- Reporting Mechanisms:

- Utilization rates of the whistleblower hotline.

- Third-Party Risk:

- Compliance rates of third-party vendors with institutional standards.

- Financial Impact:

- Overall cost of compliance and compliance expense per issue.

- Average cost of compliance-related lawsuits.

- Operational Efficiency:

- Know Your Customer (KYC) accuracy rate.

- Average time to complete KYC and client onboarding processes.

- Adoption rate of new compliance technologies.

- Detection Effectiveness:

- False positive rates from transaction monitoring systems (a reduction indicates improved accuracy).

- Number and quality of Suspicious Activity Reports (SARs) filed.

- Timeliness of SAR filings.

Qualitative Metrics: Assessing Culture and Perception

Qualitative metrics offer vital insights into the perceptions, understanding, and cultural aspects of compliance, which are harder to quantify but equally important for long-term success.

- Employee Perception:

- Feedback from employee surveys on the program's effectiveness and the perceived ethical culture ("ethics and integrity index").

- Knowledge and Understanding:

- Results from quizzes or assessments on employee comprehension of compliance policies.

- Policy Accessibility:

- Employee feedback on the ease of accessing and understanding compliance policies.

- Leadership Effectiveness:

- Assessments of how well leaders model and communicate compliance expectations.

- External Perception:

- Client feedback on the institution's commitment to integrity.

- Industry rankings or awards related to compliance and ethics.

- Program Maturity:

- Case studies analyzing instances where the compliance program successfully prevented an issue.

- Reputation and Trust:

- Gauges of customer satisfaction scores and general public perception.

A balanced scorecard approach, combining both quantitative and qualitative metrics, is crucial for a complete understanding of FCC program effectiveness. Quantitative metrics, while objective, can be misleading on their own. For example, a 100% training completion rate does not guarantee that employees understand or will correctly apply the knowledge.

Qualitative metrics provide the essential context, assessing the "soft" but critical elements like the strength of the compliance culture and employee engagement. An effective Financial Crime Compliance program is not just defined by having controls in place—which quantitative metrics can show—but by ensuring those controls function effectively within a strong ethical and risk-aware culture, which qualitative metrics help to assess. By developing a comprehensive suite of KPIs covering process, controls, outcomes, and culture, institutions can drive targeted improvements that go far beyond merely meeting numerical targets.

Table 6: Key Performance Indicators (KPIs) for Measuring FCC Program Effectiveness

| KPI Category | Specific Metric (Quantitative/Qualitative) | Description/Purpose | Target/Benchmark Considerations |

|---|---|---|---|

| Training & Awareness |

Training completion rate (Q); Employee understanding of policies (Ql) |

Measures reach and comprehension of compliance education. |

Aim for 100% completion for mandatory training; assess understanding via tests/surveys; year-over-year improvement. |

| Risk Assessment & CDD/EDD |

% of EWRAs completed on schedule (Q); % of high-risk customers with EDD completed on time (Q); KYC accuracy rate (Q) |

Assesses diligence in risk identification and customer onboarding/review. |

Internal deadlines; regulatory expectations; reduction in errors/omissions. |

| Transaction Monitoring & Detection |

False positive rate from TM (Q); Alert-to-SAR conversion rate (Q); Mean Time to Detect (MTTD) suspicious activity (Q) |

Measures efficiency and effectiveness of detection systems. |

Industry benchmarks for false positives (varies by system); consistent or improving conversion rates; reduction in MTTD. |

| SAR Reporting |

Average time to file SAR (Q); % of SARs accepted without errors (Q); Feedback from law enforcement on SAR quality (Ql) |

Evaluates timeliness and quality of regulatory reporting. |

Regulatory deadlines (e.g., 30–60 days US); aim for high acceptance rate; positive law enforcement feedback. |

| Investigations & Remediation |

Mean Time to Resolve (MTTR) incidents/alerts (Q); % of audit findings remediated on time (Q) |

Assesses efficiency of investigation processes and responsiveness to identified weaknesses. |

Internal SLAs for resolution; aim for 100% timely remediation of critical/high-risk findings. |

| Overall Program Health & Culture |

Employee survey scores on compliance culture/ethics (Ql); Whistleblower hotline utilization (Q); Cost of compliance (Q) |

Gauges employee engagement, trust in reporting mechanisms, and overall investment in compliance. |

Positive trends in survey scores; appropriate utilization levels for hotline (not too low, not excessively high); budget adherence. |

| Regulatory & Third-Party Oversight |

Number of repeat audit findings (Q); Third-party vendor compliance rates (Q) |

Indicates effectiveness of corrective actions and oversight of external risks. |

Reduction in repeat findings; high compliance rates from key vendors. |

Recent Enforcement Actions and Trends (US & UK)

Analyzing recent enforcement actions provides invaluable insight into regulatory priorities, common compliance failings, and the severe consequences of non-compliance.

United States Enforcement Trends

Office of Foreign Assets Control (OFAC) – Sanctions

- 2024 Activity: Issued 12 public enforcement actions totaling approximately $48.8 million in penalties, with half relating to Iran sanctions.

- Early 2025 Focus: Two actions related to Ukraine/Russia sanctions.

- Legislative Impact: The statute of limitations for most U.S. sanctions violations was extended from five to ten years, signaling longer-term enforcement risk.

- Recent Activity (June 2025): A civil monetary penalty against GVA Capital, Ltd. for counter-terrorism violations.

Securities and Exchange Commission (SEC) – Securities & Financial Crime

- FY 2024 Statistics: Filed 583 total enforcement actions (a 26% decrease from FY23) but obtained a record $8.2 billion in financial remedies.

- Investor Protection: Distributions to harmed investors fell to $345 million.

- Whistleblowers: Received a record number of tips (over 24,000) and awarded $255 million.

- Key Enforcement Themes:

- Off-channel communications (e.g., WhatsApp).

- Violations of the Marketing Rule.

- "AI-washing" (misleading claims about AI use).

- Crypto-asset fraud (pyramid schemes, unregistered offerings).

- Robust enforcement of whistleblower protection rules.

FinCEN and Federal Bank Regulators – BSA/AML

- 2024 Activity: Over three dozen enforcement actions against banks and individuals for BSA/AML/CFT compliance failures.

- Predominant Theme: Deficiencies across the "five pillars" of an effective BSA/AML program (internal controls, independent testing, designated officer, training, and CDD).

- Common Failings Cited:

- Inadequate board and management oversight.

- Insufficient allocation of resources to compliance.

- Outdated risk assessments.

- Ineffective transaction monitoring systems.

- Significant failures in filing SARs, often requiring "look-back" reviews.

United Kingdom Enforcement Trends

Financial Conduct Authority (FCA)

- 2024 Fines: Imposed fines totaling over £176 million across 26 cases, a significant increase from 2023.

- Investigations: While fines were up, the FCA decelerated the rate of opening new investigations, reducing its overall caseload.

- Common Financial Crime Failings:

- Inadequate or poorly implemented policies and procedures.

- Deficient financial crime risk assessments.

- Failure to conduct proper CDD or EDD.

- Weaknesses in transaction monitoring.

- Notable Cases:

- Starling Bank: Fined £28.9 million for sanctions failings, including poor alert management.

- Metro Bank: Fined £16.6 million for serious deficiencies in its automated transaction monitoring system.

Key Cross-Jurisdictional Theme: "Tone from the Top" and Resource Allocation

A critical theme across all jurisdictions is the regulatory focus on leadership. Numerous actions in 2024, such as the nearly $1.9 billion penalty against TD Bank, explicitly cited a failure of board and senior management oversight and a "flat cost paradigm" that prioritized profits over necessary compliance investment. This lack of commitment from the top is consistently identified as the root cause of systemic deficiencies across all pillars of Financial Crime Compliance. Regulators are increasingly holding boards and senior management directly accountable, reinforcing that a superficial "lip service" approach to compliance is a clear path to severe regulatory action.

Lessons from Landmark Financial Crime Scandals

Major scandals provide stark lessons on the devastating consequences of compliance failures.

Danske Bank (Estonian Branch)

- The Failure: Over €200 billion in suspicious transactions flowed through the branch from high-risk non-resident clients due to grossly inadequate due diligence, insufficient transaction monitoring, and a lack of headquarters oversight.

- The Consequence: Fines exceeding €2 billion, profound reputational damage, and leadership overhaul.

Wirecard (Germany)

- The Failure: A spectacular collapse after a €1.9 billion hole was found in its books, exposing years of falsified accounts, weak internal controls, and insufficient auditor scrutiny.

- The Consequence: Bankruptcy, widespread legal action, and a significant blow to trust in Germany's financial oversight systems.

1Malaysia Development Berhad (1MDB)

- The Failure: Billions of dollars were systematically looted from Malaysia's sovereign wealth fund and laundered through major global banks, who ignored significant red flags related to Politically Exposed Persons (PEPs).

- The Consequence: Multi-billion-dollar penalties for major financial institutions like Goldman Sachs and ongoing reputational damage.

Common Failures Across Major Scandals

- Inadequate Due Diligence: Failure to properly scrutinize high-risk customers like PEPs.

- Weak Transaction Monitoring: Ineffective systems that failed to detect suspicious patterns.

- Governance and Accountability Gaps: A poor "culture of compliance" and lack of accountability at the senior leadership level.

- Insufficient Focus on Third-Party Risks: Inadequate oversight of vendors and agents.

- Overreliance on Manual Processes: Inefficient legacy systems unable to cope with modern transaction volumes.

The Ultimate Failure: Ignoring Known Red Flags

A pervasive theme is the failure to act on clear warning signs. In many cases, red flags were identified but were either ignored, dismissed, or a culture of conflicting business pressures discouraged their escalation. This indicates the failure often lies not just in detection, but in the response. A robust FCC framework requires not only effective detection systems but also a strong investigative capacity and a culture where raising concerns is encouraged and acted upon.

Comparative Insights: Large Banks vs. Fintech Startups

Regulatory Environment

- Large Traditional Banks: Operate under a stringent, comprehensive regulatory regime with mandatory deposit insurance, high capital reserves, and frequent examinations.

- Fintech Startups: Often operate under lighter or more ambiguous frameworks, frequently partnering with chartered banks to offer regulated services like FDIC-insured accounts.

Operational Models and Innovation

- Large Traditional Banks: Often contend with legacy technology, but bring decades of risk management experience and significant financial resources.

- Fintech Startups: Characterized by agility, rapid product iteration, and technology-first, customer-focused models, unencumbered by legacy systems.

Financial Crime Compliance (FCC) Programs

- Large Traditional Banks: Have large, mature compliance departments but may struggle with bureaucratic processes and updating legacy systems.

- Fintech Startups: More likely to build with technology and automation from the outset, but can face challenges in scaling compliance functions to keep pace with rapid growth.

The Convergence Challenge: Integrating Agility with Regulatory Rigor

The lines between banks and fintechs are blurring, creating a significant challenge: integrating fintech innovation with the rigorous demands of Financial Crime Compliance. Banks must become more agile, while fintechs must adopt a "compliance by design" approach, embedding robust compliance into their products from the very beginning. As fintechs mature, regulators will inevitably expect them to meet compliance standards comparable to those of traditional banks for all bank-like functions.

VI. The Evolving Horizon of Financial Crime Compliance

The domain of Financial Crime Compliance is in a state of perpetual evolution, driven by the increasing sophistication of criminal methodologies, rapid technological advancements, and a responsive, ever-tightening regulatory landscape. Financial institutions must remain vigilant and adaptive to navigate this dynamic environment effectively. This section explores key emerging threats and anticipates the future trajectory of the ongoing battle against financial crime.

Emerging Threats and Typologies

Financial criminals consistently demonstrate increased sophistication, adeptly leveraging new technologies and exploiting vulnerabilities in evolving financial systems. This "cat and mouse" dynamic, where criminals devise new schemes and compliance functions subsequently adapt, is accelerating due to the rapid pace of technological change.

Key emerging threats include:

- Sophistication through Technology (Weaponized AI): Criminals are quick to adopt and misuse emerging technologies. Generative Artificial Intelligence (GenAI) is being weaponized to create highly convincing deepfakes for impersonation fraud, craft sophisticated phishing emails, manipulate identity verification (ID&V) documents, and recruit unsuspecting individuals into becoming money mules.

- Cyber-Enabled Financial Crime: The threat from cybercrime continues to grow, with ransomware attacks, account takeovers (ATO), and various forms of phishing remaining prevalent. These activities not only constitute direct financial crimes but also serve as critical predicate offenses for money laundering.

- Exploitation of Digital Assets: Cryptocurrencies and other virtual assets are increasingly misused for a range of illicit purposes, including money laundering, terrorist financing, sanctions evasion, and funding activities like fentanyl trafficking and organized crime. The use of Convertible Virtual Currency (CVC) mixing services to obscure transaction trails poses a particular challenge to investigators.

- Convergence of Fraud and AML: There is a growing recognition of the intricate links and convergence between fraud and money laundering. Illicit proceeds from sophisticated fraud schemes often require laundering to be used by criminals, blurring the lines between traditional fraud prevention and AML/CFT efforts.

Reduce your

compliance risks