Financial Services Compliance

Financial services compliance refers to the adherence of banks, insurers, asset managers, fintech firms and other financial institutions to the laws, regulations, and standards governing the financial industry.

Financial services compliance refers to the adherence of banks, insurers, asset managers, fintech firms and other financial institutions to the laws, regulations, and standards governing the financial industry. In today’s complex environment, compliance is both a legal obligation and a cornerstone of trust and stability in financial markets. Regulatory frameworks have evolved over decades – from early banking regulations to the post-2008 wave of reforms, and continue to expand across all major sectors. This comprehensive report delves into the historical context of financial services compliance, examines key regulatory frameworks in banking, insurance, asset management, and fintech (with a focus on Europe), and explores current developments (2023–2025), challenges, and best practices.

Financial Services Compliance: Origins, Evolution, and Significance

Financial services compliance traces back to the earliest measures designed to uphold financial stability and safeguard market integrity. Over time, large-scale crises and scandals across banking and financial markets spurred the enactment of stricter standards. A notable example is the formation of the Basel Committee on Banking Supervision in 1974, established in response to major bank failures, which introduced the inaugural Basel Accord on bank capital in 1988. Subsequent milestones have ranged from the anti-money laundering (AML) laws emerging in the 1990s to the corporate governance reforms of the early 2000s. Following the global financial crisis of 2007–2008, sweeping changes were made worldwide, such as the Dodd-Frank Act in the United States (2010) and the establishment of new European supervisory agencies (EBA, ESMA, EIOPA in 2011).

Today’s financial services compliance environment is in constant flux. In 2022 alone, over 61,000 regulatory updates, among the highest levels since 2008, were issued in global banking and finance. This pace reflects both the introduction of entirely new directives and frequent revisions to existing ones. Compliance officers must oversee a vast assortment of requirements, encompassing prudential guidelines, market conduct obligations, consumer safeguards, anti-financial crime directives, and data privacy mandates. The scope is also global in nature: more than 200 jurisdictions have pledged to implement the Financial Action Task Force’s AML/CFT standards. Despite this international coordination, regional and sector-specific variations abound, necessitating local expertise for effective compliance.

Evolution of Financial Services Compliance: Key Milestones

- 1970s–1980s:

- Establishment of global regulatory bodies (e.g., Basel Committee in 1974).

- Introduction of the first international banking capital framework, known as the Basel I Accord (1988).

- Initial AML legislation, such as the U.S. Bank Secrecy Act (1970) and the first EU AML Directive (1990).

- 1990s:

- The European Union progresses toward a unified financial market, issuing directives for banking, securities, and insurance.

- Creation of the Financial Action Task Force (FATF, 1989) and the publication of its 40 AML Recommendations as a global benchmark.

- Early 2000s:

- High-profile corporate collapses (e.g., Enron, WorldCom) catalyze the Sarbanes-Oxley Act (2002), emphasizing corporate governance and internal controls.

- Basel II (2004) adopts more nuanced, risk-based capital requirements.

- MiFID I (2004) in the EU aims to harmonize securities regulations.

- Post-2008 Crisis:

- Extensive reforms target systemic stability and consumer protection. Basel III (2010) raises capital and liquidity thresholds for banks.

- The EU enacts CRD IV/CRR to implement Basel III, and forms the European Supervisory Authorities (ESMA, EBA, EIOPA) in 2011.

- The U.S. passes Dodd-Frank (2010) to strengthen oversight of banks and capital markets.

- MiFID II (2014, effective 2018) in the EU intensifies investor protection and market transparency.

- Additional reforms address derivatives (EMIR 2012), insurance solvency (Solvency II 2016), and bank resolution (BRRD 2014).

- Late 2010s:

- The compliance focus broadens to data protection (EU’s GDPR, 2018), financial crime (EU’s 4th and 5th AML Directives, 2015–2018), and market integrity (Market Abuse Regulation 2016).

- Enforcement escalates, with financial institutions receiving multi-billion-euro penalties for AML and sanctions violations.

- 2020s:

- Rapid advancements in fintech and digital finance lead to new rules: open banking (PSD2, 2018, and the upcoming PSD3), crypto-asset governance (EU’s MiCA, 2023), and operational resilience (EU’s DORA, 2022).

- Post–COVID-19 concerns about resilience and business continuity intensify.

- Environmental, social, and governance (ESG) criteria gain momentum, with regulators addressing greenwashing risks and integrating climate considerations into compliance frameworks.

Importance of Compliance in the Financial Services Sector

Robust financial services compliance programs protect consumers and investors, uphold market integrity, and mitigate systemic threats. They also shield organizations from fines, reputational harm, and operational disruptions. For instance, banks lacking sufficient AML controls have faced multimillion-euro fines or, in extreme cases, lost their licenses. Meanwhile, non-compliance with GDPR has led to penalties amounting to €5.88 billion since 2018.

Regulators emphasize that compliance is ultimately the responsibility of senior management, integral to a firm’s overall risk strategy. A Basel Committee publication highlights that the chief function of compliance is to contain the risks of legal or regulatory sanctions, financial damage, or reputational harm resulting from non-adherence to standards. In essence, financial services compliance is not merely a safeguard against punishments; it forms the foundation of trust for customers and stakeholders in the financial system.

Key Regulatory Bodies and Global Standards in Financial Services Compliance

Financial services compliance operates within a complex, multi-tiered regulatory network, encompassing global, regional, and national frameworks. Compliance teams must be aware of these structures to navigate overlapping mandates effectively.

Global Standard-Setters

Organizations such as the Basel Committee on Banking Supervision (BCBS), Financial Stability Board (FSB), Financial Action Task Force (FATF), International Organization of Securities Commissions (IOSCO), and International Association of Insurance Supervisors (IAIS) issue high-level standards and recommendations. Although these standards (e.g., Basel III, FATF’s 40 Recommendations) are not, in themselves, binding laws, national regulators frequently adopt them:

- Basel III: Implemented across numerous jurisdictions to enhance bank capital and liquidity.

- FATF’s AML/CFT framework: Followed by over 200 jurisdictions via regional bodies, reflecting the global commitment to combat money laundering and terrorist financing.

European Union (EU) Regulators

In the EU, financial services compliance primarily stems from Regulations and Directives proposed by the European Commission and approved by the European Parliament and Council. Key supervisory and enforcement actors include:

- European Supervisory Authorities (ESAs):These bodies release technical standards and guidance to align supervisory practices among EU member states. ESMA’s MiFID II guidelines, for example, detail how compliance functions should handle product oversight and reporting to senior management. Similarly, the EBA provides internal governance guidelines demanding that banks integrate AML controls into broader compliance frameworks.

- European Banking Authority (EBA)

- European Securities and Markets Authority (ESMA)

- European Insurance and Occupational Pensions Authority (EIOPA)

- National Regulators:

Each EU member state retains its own supervisory agencies (such as central banks and market authorities) to license financial institutions, enforce EU-level directives, and often layer on country-specific requirements. Post-Brexit, the UK’s Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA) maintain a distinct regulatory framework, still largely influenced by global standards but diverging in certain respects. - European Central Bank (ECB):

Under the Single Supervisory Mechanism, the ECB directly supervises major euro-area banks, ensuring their compliance with prudential rules (Basel/CRD) in partnership with national supervisory bodies.

United States and Other Jurisdictions

In the U.S., financial services compliance is spread among multiple agencies—such as the Federal Reserve, Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC), Securities and Exchange Commission (SEC), and Commodity Futures Trading Commission (CFTC)—as well as state-level regulators. Comparable models exist worldwide (e.g., Japan’s FSA, China’s CBIRC and CSRC). While this overview concentrates on European regimes, global organizations must reconcile numerous rule sets, noting that many non-EU jurisdictions mirror EU or international templates (e.g., GDPR-like data protection laws, Basel III for banking).

Enforcement and Guidance

Regulatory bodies ensure adherence to requirements through on-site examinations, investigations, and sanctions. They also provide interpretive guidance:

- ESMA and EBA Publications: Frequent Q&As, opinions, and recommendations that clarify complex regulations.

- European Commission: Conducts risk assessments and tracks the transposition of directives by member states.

- FATF: Reviews countries’ AML compliance and issues “grey” or “black” lists to spotlight jurisdictions posing heightened risk.

- Basel Committee: Monitors the uniform application of Basel III globally.

Harmonization vs. Local Nuance

While the international regulatory framework strives to harmonize standards, particularly in areas like AML, coordinated by FATF and EU directives, significant differences remain in topics such as consumer financial protection. Consequently, financial services compliance professionals in multinational institutions must adeptly manage both global policies and the local variations that shape day-to-day operations. This dual mandate underlines the importance of staying up to date with ever-evolving rules and aligning internal processes to meet both universal and jurisdiction-specific requirements.

Banking Sector Compliance: Prudential Standards, Conduct Rules, and Resilience

As a cornerstone of financial services compliance, the banking sector is subject to extensive oversight to uphold financial stability and thwart financial crimes. From capital requirements to consumer protection, banks must navigate numerous regulations that safeguard both the market and end customers.

Basel III and Capital Regulations

In response to the 2008 financial crisis, Basel III introduced sweeping changes to bank capital and liquidity standards. Notable elements include higher-quality capital requirements, new capital buffers, leverage constraints, and liquidity ratios (LCR, NSFR) designed to strengthen banks against economic shocks.

- Goals: Lower the likelihood and impact of banking crises.

- EU Implementation: Enshrined via the Capital Requirements Directive (CRD V/VI) and Capital Requirements Regulation (CRR). Compliance entails meeting minimum capital ratios (e.g., CET1), conducting internal capital adequacy assessments (ICAAP), and maintaining adequate liquidity.

- Basel III Endgame (Basel IV): As of 2023, revisions to risk-weight calculations are set to phase in by 2025, reinforcing prudential requirements.

Governance and Risk Management

Regulatory expectations for financial services compliance in banks also extend to internal governance. The European Banking Authority (EBA) Guidelines on Internal Governance (2021) oblige boards and executives to oversee compliance culture, incorporating AML/CFT risk into overarching risk frameworks. Key practices include:

- Chief Compliance Officer: Many jurisdictions require a formally appointed CCO.

- Three Lines of Defense: Separates frontline operations from risk/compliance oversight and internal audit.

- Conflict of Interest Management: EBA rules address issues like loans to directors (eba.europa.eu).

- Remuneration: Policies must discourage misconduct and encourage prudent risk-taking.

Conduct and Consumer Protection

In the EU, MiFID II applies to banks delivering investment services. It demands fair treatment of clients, proper disclosure of fees, conflict-of-interest mitigation, and suitable product offerings. Banks must:

- Act in Clients’ Best Interests: Provide suitable investment advice and transparent cost details.

- Transaction Transparency: Comply with reporting obligations for trades in financial instruments.

- Consumer Safeguards: Additional rules govern retail banking (e.g., consumer credit, mortgages, deposit guarantees). Regulators enforce Treating Customers Fairly (TCF) to prevent product mis-selling.

Anti-Money Laundering (AML) and Sanctions

As the frontline in preventing illicit finance, banks are required to perform robust customer due diligence (KYC), transaction monitoring, and suspicious activity reporting. AML directives in the EU, alongside national laws, mandate internal AML policies, staff training, and periodic independent audits.

- Sanctions Compliance: Screening for prohibited entities (UN, EU, OFAC lists) to avoid severe penalties.

- Technology: Banks increasingly deploy advanced analytics, including AI, to spot suspicious patterns.

Operational Resilience

Banks must also address operational continuity under financial services compliance mandates. The EU’s Digital Operational Resilience Act (DORA) takes effect on January 17, 2025, obligating banks to maintain strong ICT risk management, conduct cyber testing, and oversee third-party technology providers. Prior to DORA, the ECB and UK PRA also issued guidelines on outsourcing risk and business continuity. Under DORA, banks will:

- Test Critical Systems: Regularly evaluate for vulnerabilities.

- Implement Incident Response Plans: Have procedures ready for handling severe operational disruptions.

Supervision and Reporting

Banks face rigorous monitoring from regulators, submitting detailed reports on capital (COREP), financials (FINREP), exposures, and liquidity.

- Senior Manager Accountability: In some regimes (e.g., the UK’s SMCR), individual executives bear personal responsibility for compliance.

- On-Site Examinations: Regulators can impose remedial measures, fines, or other sanctions if deficiencies are identified.

Securities and Asset Management: Upholding Market Integrity and Investor Protection

Within financial services compliance, the securities and asset management sector faces robust regulations aimed at preserving transparent markets and safeguarding investors’ interests. Whether operating as an investment bank, brokerage firm, fund manager, or exchange, these entities often navigate overlapping regulatory regimes when banking activities and securities services converge.

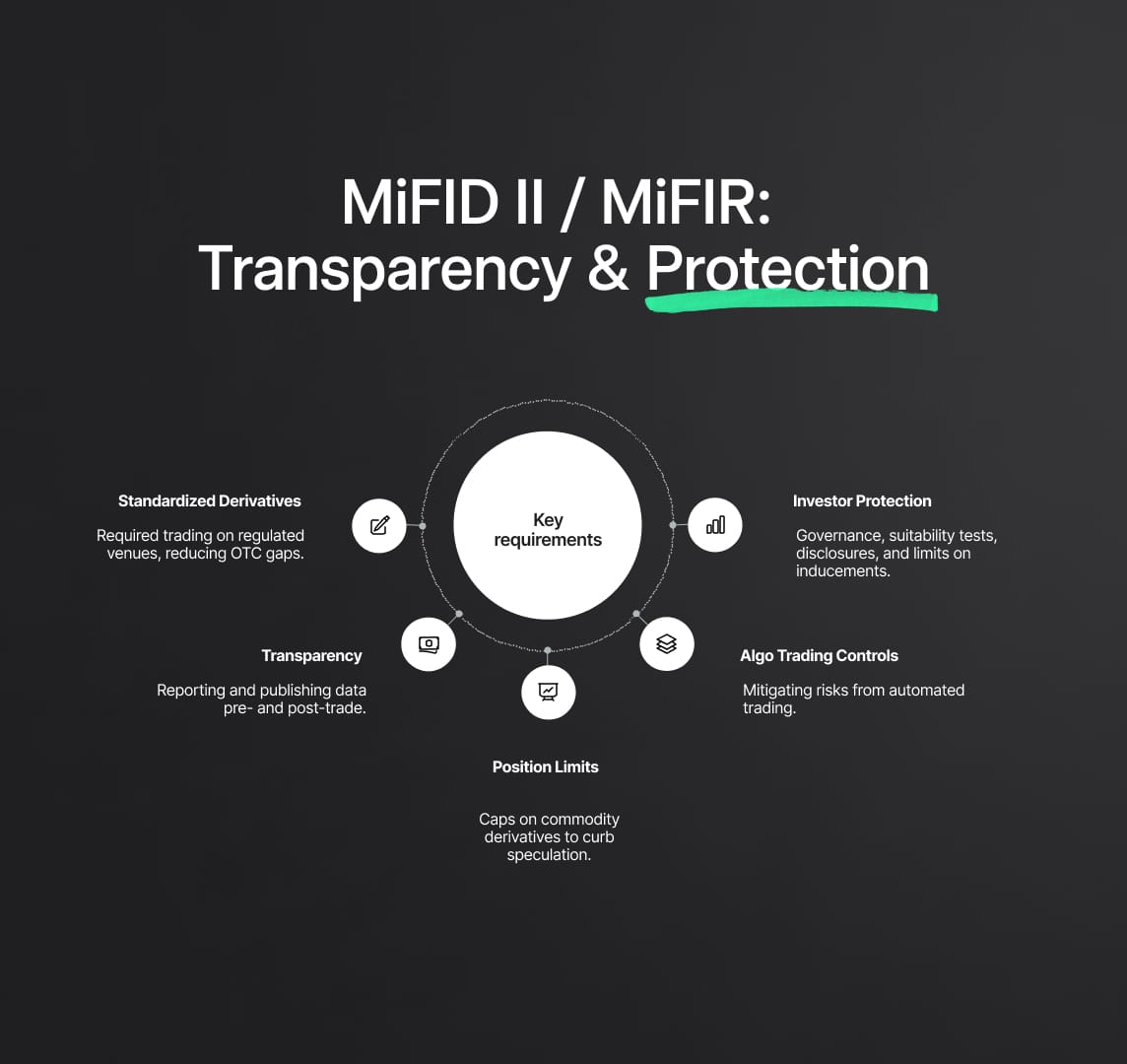

MiFID II / MiFIR – Market Transparency and Investor Protection

Regarded as a cornerstone of EU capital markets regulation, the Markets in Financial Instruments Directive II (MiFID II, Directive 2014/65/EU) and its companion Regulation (MiFIR) promote fairness, transparency, and enhanced investor safeguards. Key requirements under MiFID II include:

- Standardized Derivatives: Mandated trading on regulated venues, closing gaps in over-the-counter (OTC) trading.

- Pre- and Post-Trade Transparency: Firms must report and publish details for a broad range of financial instruments.

- Commodity Derivative Position Limits: Limits to deter excess speculation.

- Algorithmic Trading Controls: Measures to mitigate systemic risks from high-frequency trading.

- Investor Protection Rules: Product governance, suitability and appropriateness tests, cost disclosures, and restrictions on inducements.

Compliance Obligations: Investment firms must maintain accurate trade reporting, monitor conflicts of interest, and ensure staff are properly qualified and incentivized to serve client best interests. The European Securities and Markets Authority (ESMA) and national regulators watch implementation closely, including direct supervision of certain data reporting entities under MiFID II. Recent reforms, often labeled “MiFID II quick fixes,” streamline some provisions to support economic recovery, while further reviews continue into 2023–2024.

Market Abuse Regulation (MAR): Preventing Insider Trading and Manipulation

The EU Market Abuse Regulation (MAR, Regulation 596/2014) underpins market integrity by forbidding insider trading, unlawful disclosure of inside information, and any form of market manipulation. Firms must install surveillance systems to detect questionable trading activities or patterns. Compliance teams typically:

- Report Suspicious Transactions (STORs): Promptly notify regulators when insider dealing or manipulation is suspected.

- Manage Disclosure: Publicize inside information that could influence security prices, subject to narrowly defined exceptions.

- Oversee Personal Account Dealing: Maintain insider lists and implement staff training to prevent abuses.

Violations can lead to significant fines and criminal prosecutions, demonstrating the high priority regulators place on financial services compliance in market activities.

Asset Management Regulations (UCITS, AIFMD, etc.)

Asset managers must comply with specialized frameworks designed to protect investors and ensure responsible fund management:

- UCITS Directive: Applies to retail mutual funds, setting standards on permissible investments, diversification, custody arrangements, and disclosure (such as the Key Investor Information Document). UCITS are often viewed globally as a benchmark for investor protection.

- AIFMD (Alternative Investment Fund Managers Directive): Governs hedge, private equity, real estate, and other alternative funds. It requires authorization, minimum capital, risk and liquidity management protocols, and periodic transparency reporting to regulators and investors. The introduction of a depositary for fund assets—aimed at preventing fraud—was largely a response to past scandals.

Many asset managers also come under MiFID II when providing advisory services, and they must comply with AML/KYC rules to prevent illicit financial flows. Appointing a Money Laundering Reporting Officer (MLRO) and conducting thorough investor checks have become standard practice in financial services compliance.

Fiduciary Duty and Conduct

A core element of financial services compliance for asset managers involves acting as a fiduciary—managing client assets prudently and prioritizing client objectives. Regulators enforce fiduciary principles through:

- Best Execution: Ensuring trades are executed on the best terms for clients.

- Conflict of Interest Management: Disclosing or avoiding practices that could compromise objectivity (e.g., favoring funds that pay higher fees).

- Valuation and Reporting: Fairly valuing assets and maintaining transparent reporting.

Voluntary codes, such as the CFA Institute’s Asset Manager Code, also shape industry best practices. In the U.S., the Securities and Exchange Commission (SEC) enforces parallel standards under the Investment Advisers Act, mandating compliance programs and a Chief Compliance Officer for registered advisers.

Clearing, Settlement, and Infrastructure

Market infrastructure entities—exchanges, central counterparties, trade repositories—face regulations to maintain stability and efficient operations. Under the European Market Infrastructure Regulation (EMIR), standardized derivatives must be centrally cleared, and all derivatives trades reported to authorized repositories. Central clearinghouses are subject to rigorous margin and default fund requirements, while the Central Securities Depositories Regulation (CSDR) harmonizes settlement processes and enforces penalties for settlement failures. Banks and brokers must align their operations with these rules, ensuring timely clearing and settlement to remain fully compliant.

Supervisory Expectations

ESMA issues detailed guidance for financial services compliance functions in investment firms, such as its MiFID II compliance guidelines, recommending that compliance officers participate in new product reviews, monitor employee conduct, and report to senior management on emerging risks. Other ESMA guidelines address suitability and remuneration, seeking to prevent client harm through inappropriate pay structures. National regulators also conduct periodic themed reviews—assessing best execution practices, insider trading controls, and more—leading to further guidance or potential enforcement action.

Insurance Sector: Solvency and Consumer Protection

Within financial services compliance, the insurance sector has a specialized regulatory framework that is comparable in scale and complexity to the banking industry. Insurers must maintain adequate capital to protect policyholders while observing fair market conduct rules. This dual focus underpins confidence in insurers’ ability to pay claims and in the industry’s integrity.

Solvency II (EU) Framework

Introduced in 2016, Solvency II provides a comprehensive EU-wide prudential regime for insurers, mirroring the “three-pillar” model seen in Basel regulations:

- Quantitative Capital Requirements (Pillar I):

- Calculation of the Solvency Capital Requirement (SCR) to withstand a 1-in-200-year event.

- Risk-based capital measures: higher-risk investments or liabilities necessitate more capital.

- Governance and Risk Management (Pillar II):

- Own Risk and Solvency Assessment (ORSA): Regular internal evaluation of risk exposures and capital adequacy.

- Clear board responsibilities, with dedicated risk management, actuarial, and compliance functions.

- Reporting and Disclosure (Pillar III):

- Detailed supervisory reporting, plus public disclosures on solvency ratios and risk profiles.

Compliance teams handle complex actuarial modeling, data quality reviews, and scenario testing to meet these obligations. National insurance supervisors, coordinated by the European Insurance and Occupational Pensions Authority (EIOPA), monitor SCR levels and can intervene if solvency ratios decline. Recent EU changes aim to refine capital requirements for long-term investments without compromising policyholder protection.

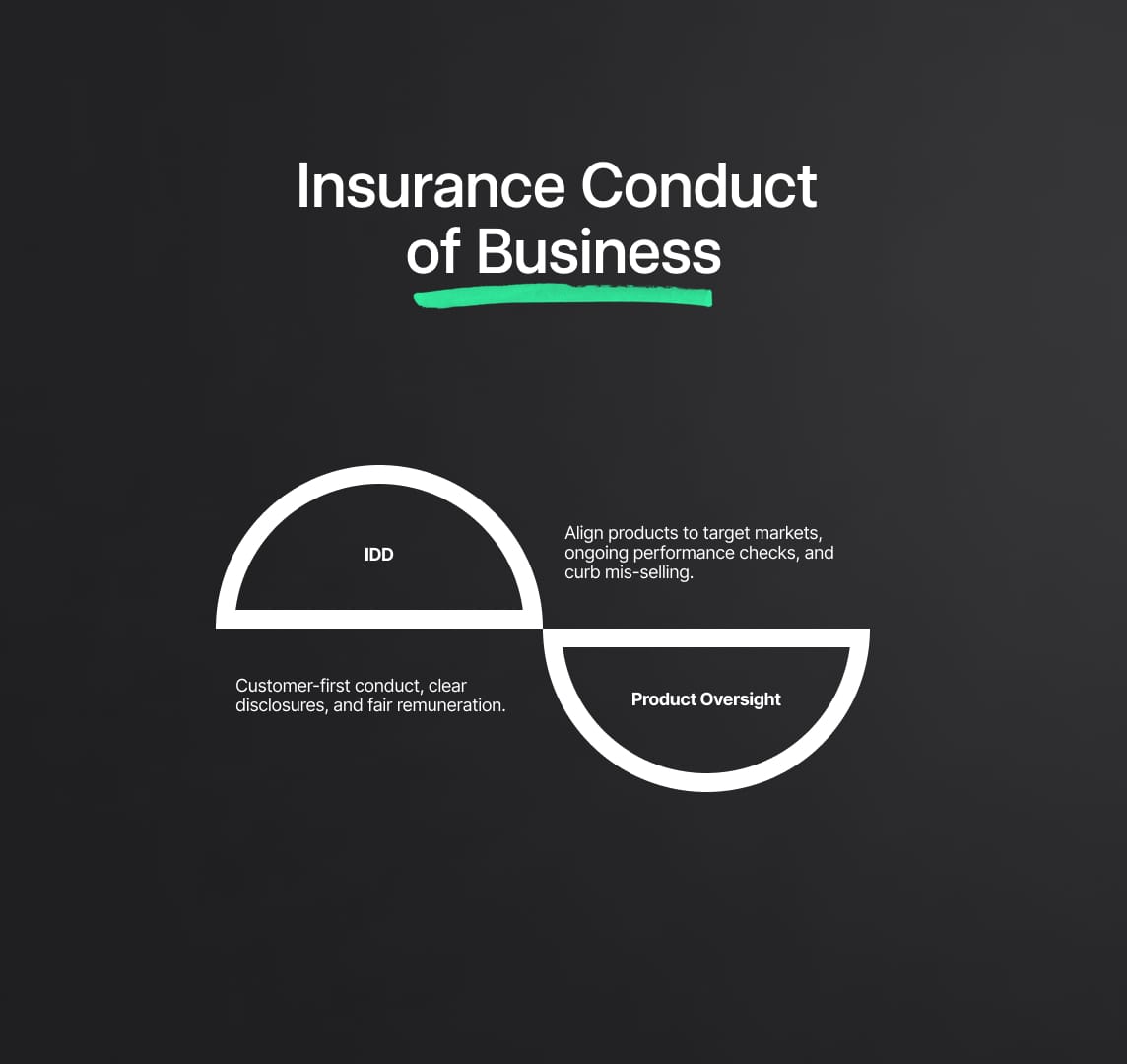

Insurance Conduct of Business

Insurers must not only remain solvent but also uphold fair dealing in product distribution:

- Insurance Distribution Directive (IDD):

- Requires intermediaries and insurers to act with honesty and in customers’ best interests.

- Mandates suitable product disclosure, conflict-of-interest management, and proper remuneration practices.

- Product Oversight and Governance:

- Firms must match product offerings to suitable target markets, monitor product performance, and ensure sales practices prevent mis-selling.

- Historical issues like payment protection insurance (PPI) scandals have prompted stricter scrutiny of marketing and sales conduct.

Effective financial services compliance ensures that sales representatives have adequate training, promotional materials are accurate, and claims are settled fairly. Supervisors closely monitor outcomes for policyholders, focusing particularly on timely and equitable claim handling.

Consumer Protection and Transparency

Insurance contracts can be intricate, prompting regulators to require straightforward documentation such as Key Information Documents (KIDs) to clarify coverage, exclusions, and costs. Additionally, GDPR has significant implications for insurers handling sensitive data (e.g., health information for life insurance), making privacy and data security vital compliance concerns. Many jurisdictions also ban unfair contract terms and demand plain-language policy explanations to protect consumers.

AML and Sanctions in Insurance

Because life insurance products may be exploited for money laundering or terrorist financing, insurers fall under AML/CFT regulations. Key elements include:

- KYC checks on policyholders and beneficiaries.

- Monitoring large premium payments and early surrenders.

- Reporting suspicious transactions to authorities.

Sanctions compliance similarly requires screening to avoid underwriting or paying out to sanctioned individuals or entities. Heightened scrutiny around beneficial ownership remains a compliance challenge, especially after a 2022 EU court ruling limited public access to ownership registers.

Supervision and Guarantee Schemes

Insurance supervisors—often separate from banking regulators—conduct in-depth assessments of insurers’ governance structures, sometimes reviewing internal models used to determine capital requirements. Should an insurer fail, many countries have insurance guarantee schemes or policyholder protection funds, though regulators emphasize solvency rules as the primary defense against insolvency. Stress testing (for pandemics, natural catastrophes, climate change) has also gained attention, reflecting the evolving risk landscape.

Global Standards

Outside the EU, various jurisdictions adopt risk-based capital regimes inspired by Solvency II—for example, Switzerland’s SST, Canada’s LICAT, and adaptations in Asia. The International Association of Insurance Supervisors (IAIS) is progressing toward a global Insurance Capital Standard. Although the United States maintains a factor-based RBC approach, it is gradually aligning with certain international practices. For compliance professionals, these moves signal a worldwide push toward robust enterprise risk management.

Fintech and Cryptocurrency: Cutting-Edge Challenges in Financial Services Compliance

The fintech revolution—spanning online banks, payment facilitators, digital lending platforms, robo-advisors, and cryptocurrency exchanges—has disrupted traditional finance, compelling regulators to adapt financial services compliance frameworks. Many fintech offerings do not fit neatly into pre-existing categories, while some give rise to entirely new regulatory concerns.

Payments and Open Banking (PSD2 and Beyond)

The Revised Payment Services Directive (PSD2), effective in 2018, introduced open banking in the EU by requiring banks to share certain data and payment functionalities with third-party providers through secure APIs. Compliance for payment service providers entails:

- Licensing and Safeguarding Funds: Proper authorization and protection of client money.

- Strong Customer Authentication: Stringent security protocols to reduce fraud.

- Dispute Resolution: Clear processes for refunds and complaints.

In 2023, the European Commission proposed PSD3 and a new Payment Services Regulation (PSR), aiming to tighten fintech oversight and bolster consumer protections, such as streamlined refund rules. Meanwhile, these directives also require AML measures—payment startups, e-money institutions, and other fintechs must deploy KYC checks and transaction monitoring from the start.

Digital Banking and Challenger Banks

Neobanks offering deposit-taking or lending generally need a banking license or must collaborate with an existing bank. In Europe, some fintech challengers have obtained full licenses, thus coming under Basel/CRD capital standards. Compliance personnel face the task of upholding conventional regulatory obligations within new digital-only business models:

- Digital Onboarding: Must meet stringent e-KYC requirements to satisfy anti-money laundering and know-your-customer obligations.

- Cloud Outsourcing: Regulators such as the European Banking Authority (EBA) demand robust oversight of third-party cloud providers.

Ultimately, digital banks must demonstrate the same prudential rigor as traditional banks, even if their operations differ substantially.

Cryptocurrency and Digital Assets (MiCA)

By 2023, crypto-assets had matured into a significant market, prompting a major compliance development: the Markets in Crypto-Assets Regulation (MiCA). This EU law:

- Mandates Licensing: Crypto exchanges and wallet providers must obtain authorization and meet minimum capital thresholds.

- Stablecoin Oversight: Issuers must maintain reserves and adhere to governance norms.

- Market Integrity: Firms must monitor for insider trading and manipulation, akin to traditional securities regulations.

MiCA provisions will gradually apply from 2024 to 2025. Even before MiCA, the 5th AML Directive extended AML/CFT duties to crypto exchanges and wallet services. Compliance now also involves sanction screening and the upcoming “travel rule” for crypto transfers (via the updated EU Transfer of Funds Regulation, effective December 2024), aligning with FATF standards.

Regulatory Sandboxes and Innovation Offices

Many regulators have established sandboxes that allow fintechs to test innovations under lighter supervision. The UK initiated this trend, and the EU is exploring a blockchain-focused sandbox and broader Open Finance initiatives. While sandboxes offer guidance and relaxed rules for emerging technologies, fundamental financial services compliance requirements (e.g., AML) still apply.

Artificial Intelligence (AI) in Finance

AI-powered services, ranging from robo-advisors to credit scoring algorithms, are expanding quickly. However, regulators foresee potential risks:

- EU AI Act: Expected around 2024, may classify certain financial AI systems as high-risk, imposing transparency and risk management obligations.

- Model Risk: Financial regulators stress the need to control bias and ensure reliability.

- Suitability Standards: Robo-advisors must still meet investor-protection mandates, even if recommendations stem from AI-driven processes.

Compliance teams are increasingly involved in AI governance, ensuring these tools comply with consumer protection and data privacy laws.

Cybersecurity and Fraud Prevention

Fintech’s digital nature heightens cybersecurity standards:

- Operational Resilience: Regulations like DORA (Digital Operational Resilience Act) will encompass crypto services and other fintechs, requiring robust ICT risk controls, incident reporting, and testing.

- Fraud Monitoring: Ongoing oversight to detect phishing, identity theft, or unauthorized transactions.

Partnerships with traditional banks often hinge on robust security measures, making IT risk a cornerstone of financial services compliance.

Beyond the Horizon: DeFi and RegTech

Decentralized Finance (DeFi) raises further questions: how do AML regulations apply when no single entity controls a protocol? Policymakers are debating how to assign compliance obligations in decentralized ecosystems. Simultaneously, RegTech innovations help streamline tasks like automated AML monitoring and regulatory reporting. Even with these tools, regulated firms must verify that they meet local and international standards.

Cross-Cutting Regulations Shaping Financial Services Compliance

Certain frameworks affect all segments of the financial industry—banking, securities, insurance, and fintech—forming the core of financial services compliance. These standards address anti-money laundering, data protection, operational resilience, and more.

Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT)

One of the most universally applied regulations, AML/CFT obligations help prevent criminals and terrorists from exploiting financial systems. In the EU, AML directives have evolved continuously since 1990:

- Early Directives: Introduced customer due diligence and suspicious activity reporting.

- 4th and 5th AMLD: Strengthened controls over beneficial ownership, politically exposed persons (PEPs), prepaid cards, and cryptocurrencies.

- 6th AMLD (2021): Standardized money laundering offenses EU-wide and extended criminal liability to companies.

Key compliance tasks include:

- Customer Due Diligence (KYC): Verifying identity and beneficial owners, plus ongoing transaction monitoring.

- Risk-Based Approach: Enhanced checks for high-risk customers (e.g., foreign PEPs).

- Suspicious Reporting: Flagging questionable transactions to Financial Intelligence Units.

Fines and license revocations for AML failures underscore rigorous supervision. On the global front, the Financial Action Task Force (FATF) sets international AML benchmarks and inspects countries’ compliance. FATF’s focus on crypto led to the “travel rule,” echoed in the EU’s Transfer of Funds Regulation extension. Meanwhile, the EU is preparing a single AML Regulation and an EU-wide AML Authority (AMLA), expected by 2024, further centralizing AML enforcement and tightening transparency around ultimate beneficial ownership.

Sanctions Compliance

Closely tied to AML, sanctions compliance involves screening customers and transactions to ensure no dealings with banned individuals, entities, or regions. High-profile sanctions on Russia in 2022–2023 exemplify the swift changes and severe penalties for violations. Global institutions must balance overlapping sanction regimes (UN, EU, U.S. OFAC), often defaulting to the strictest interpretations.

Data Protection (GDPR and Beyond)

Implementing data protection rules is critical in financial services compliance. The EU’s General Data Protection Regulation (GDPR) enforces:

- Lawful Processing: Clear legal grounds for data usage.

- Individual Rights: Access, deletion, and portability of personal data.

- Breach Reporting: Notification of authorities within 72 hours for serious incidents.

Non-compliance can lead to fines up to 4% of global revenue. As of early 2025, GDPR fines exceeded €5.88 billion (dlapiper.com). Financial firms must also encrypt sensitive data, limit retention periods, and appoint privacy officers or Data Protection Officers (DPOs). With similar rules emerging worldwide (e.g., Brazil’s LGPD, California’s CCPA/CPRA), institutions need holistic privacy frameworks that accommodate multiple jurisdictions.

Information Security and Operational Resilience (DORA, NIS2)

Regulators have escalated operational resilience expectations across all financial entities. The EU’s Digital Operational Resilience Act (DORA) applies to banks, insurers, asset managers, crypto firms, and more, mandating:

- ICT Risk Management: Comprehensive cybersecurity procedures and incident testing.

- Third-Party Oversight: Supervision of critical service providers like cloud hosts.

- Incident Reporting: Rapid notifications of major outages or breaches.

NIS2 (the updated Network and Information Systems Directive) places additional cybersecurity obligations on critical sectors, including finance. Regulators often conduct resilience self-assessments and may require institutions to participate in cyber drills. Compliance teams typically coordinate these activities to ensure adherence to notification deadlines and best practices.

Consumer Protection and Transparency

Financial institutions must also satisfy wide-reaching consumer and marketing rules:

- Advertising Standards: Clear, non-misleading promotions, often with mandatory disclosures of fees and risks.

- Unfair Commercial Practices: Bans on deceptive or aggressive selling tactics.

- Distance Marketing: Specific safeguards when selling products online or by phone, in line with EU directives.

Compliance professionals review promotional materials, call scripts, and digital interfaces to ensure alignment with these regulations.

Tax Compliance (FATCA, CRS)

While more specialized, tax transparency laws significantly affect banks and investment entities:

- FATCA (U.S.): Requires disclosure of foreign account details for U.S. taxpayers; non-compliance risks 30% withholding.

- CRS (OECD): Similar cross-border reporting to combat tax evasion.

Compliance units typically oversee these obligations, collaborating with back-office teams to fulfill reporting requirements accurately.

Current Developments and Regulatory Trends in Financial Services Compliance

Regulation of the financial sector continues to expand and adapt, responding to emerging economic challenges, technological advances, and ongoing lessons from past incidents. Below are the most critical developments and trends shaping financial services compliance through 2023–2025.

1. Crypto and Digital Asset Regulation Ramping Up

- MiCA in the EU: The Markets in Crypto-Assets Regulation (MiCA), passed in 2023, represents one of the world’s first comprehensive crypto frameworks. By 2024–2025, crypto firms operating previously outside formal oversight must obtain licensing and satisfy robust compliance mandates. Requirements include investor disclosures, market abuse monitoring (e.g., insider trading detection), and capital safeguards for stablecoin issuers.

- Global Momentum: Other jurisdictions are following suit. The UK is formulating a broad crypto regime; the U.S. SEC has intensified enforcement on crypto tokens deemed securities. Many countries also impose stricter controls on crypto advertising and AML.

- Compliance Implications: Firms must introduce market surveillance for digital assets, implement transaction monitoring to identify illicit activity, and verify stablecoin reserves. The movement toward a regulated crypto industry reflects growing recognition of the systemic and consumer risks in this space.

2. Fintech/Banking Convergence and New EU Laws

- Expansion of Open Finance: The EU’s Financial Data Access package (June 2023), which comprises PSD3 and a forthcoming Open Finance Regulation, extends open-banking principles to other sectors (e.g., securities, insurance). This deepens financial services compliance requirements around data-sharing, customer consent, and secure APIs.

- Instant Payments Regulation: By 2025, euro instant payments must be broadly accessible and affordable, obliging banks to offer near-instant settlement. Compliance teams need to align fee structures, operational processes, and anti-fraud measures with new rules.

- Basel III Finalization (“Basel IV”) and Prudential Tweaks

- Revised Standards: The final pieces of Basel III, sometimes called Basel IV, refine credit risk and operational risk frameworks, while introducing an “output floor” to limit how much internal models can reduce capital needs. Although intended to start in 2023, many jurisdictions (EU, UK) have postponed full rollout to 2025.

- Capital Adjustments: Banks might need additional capital or revised portfolios, with financial services compliance and risk teams heavily involved in implementing these changes.

- Future Considerations: Recent banking turbulence (2023 failures in the U.S. and the Credit Suisse rescue) spurred proposals for tighter interest rate risk and liquidity standards. Discussion continues on whether capital rules should explicitly account for climate risk and other emerging threats.

4. Anti-Money Laundering Overhaul

- EU AML Authority (AMLA): Expected to begin work in 2024–2025, AMLA will supervise high-risk entities (including certain cross-border banks and crypto firms) and enforce a single EU rulebook. This approach should unify AML standards, ensuring more consistent oversight across member states.

- 7th AML Directive: On the horizon to consolidate prior directives, it aims to strengthen beneficial ownership transparency and refine due diligence. However, following a November 2022 Court of Justice of the EU (CJEU) ruling restricting public access to UBO registers, policymakers must balance privacy with transparency.

- Sanctions Complexity: Heightened sanctions on Russia underscore the need for advanced screening capabilities. Regulators expect agile systems to detect and prevent sanctions evasion, including potential crypto channels.

5. Operational Resilience Deadlines

- DORA Compliance by 2025: The Digital Operational Resilience Act (DORA) mandates that all EU financial entities—banks, insurers, asset managers, payment providers, and crypto firms—upgrade ICT risk frameworks, run cyber threat tests, and improve oversight of third-party vendors by 2025.

- Global Alignment: U.S. federal regulators, the Basel Committee, and others have also issued resilience guidance, focusing on cyber defense, cloud concentration risk, and business continuity. Compliance teams must collaborate with IT and vendor management, ensuring robust reporting of outages or breaches to supervisory authorities.

6. ESG and Climate Risk Regulations

- EU Sustainable Finance: Regulations like the Sustainable Finance Disclosure Regulation (SFDR) and the Taxonomy Regulation already impact asset managers. By 2024–2025, large banks and insurers will join expanded ESG reporting under the Corporate Sustainability Reporting Directive, disclosing how climate and environmental factors affect their balance sheets.

- Greenwashing Enforcement: Regulators now penalize misleading ESG claims, treating sustainability metrics with the same scrutiny as financial statements. Financial services compliance officers must verify the accuracy of ESG disclosures with data-based evidence.

- Board Diversity: The UK’s FCA is implementing new diversity targets for company boards in 2025, while the EU is rolling out a directive on gender balance in leadership. Social and governance factors are increasingly part of supervisory expectations.

7. Technology and SupTech

- Regulatory Tech Upgrades: Supervisors themselves are investing in SupTech to handle large datasets in near-real-time, potentially detecting issues faster and demanding more granular reporting from firms.

- RegTech Adoption: Firms are deploying AI and machine learning for anomaly detection in trading and AML processes. Guidance on explainable, unbiased AI is anticipated in 2024 and beyond, tying into the EU’s proposed AI Act.

- Data and Tech Skills: Compliance departments need in-house or external expertise to navigate advanced analytics, algorithmic risk management, and integrated data governance.

8. Individual Accountability and Enforcement

- Senior Manager Accountability: The UK’s Senior Managers and Certification Regime (SMCR) remains a model, with variants in Australia (BEAR), Hong Kong (MIC), and Ireland (SEAR starting 2023).

- Personal Liability: Regulators increasingly hold top executives liable for major compliance breaches, requiring senior managers to demonstrate “reasonable steps” to ensure compliance throughout their areas of responsibility.

9. Post-Brexit Regulatory Divergence

- Edinburgh Reforms (UK, 2022): Aim to adapt or replace certain EU-inherited rules—e.g., tweaking MiFID II provisions on investment research, revising Solvency II capital for insurers.

- EU Continues Apace: Meanwhile, the EU progresses with its own reforms in areas like ESG, open finance, and AML.

- Compliance Impact: Cross-border firms must watch for diverging standards between the UK and EU, adjusting policies to avoid regulatory gaps or duplications.

Compliance Challenges and Best Practices

Given the breadth of obligations described, financial institutions face significant challenges in maintaining compliance. Below we outline key challenges and then highlight best practices that leading institutions use to build robust compliance programs.

Key Challenges

- Regulatory Change and Complexity: The pace of regulatory change is relentless (dozens of new or amended rules each year), making it challenging to keep track. Institutions operating globally must reconcile sometimes conflicting requirements. Constant change strains resources and requires effective horizon-scanning and implementation processes.

- Resource Constraints and Cost: Compliance is costly – large banks employ thousands in compliance roles and spend billions on systems. Smaller institutions and fintech startups struggle to afford necessary compliance infrastructure. Yet cutting corners can lead to even costlier enforcement actions. There’s also a talent shortage for experienced compliance professionals, driving turnover and salary inflation. Balancing budgets while meeting regulatory expectations is an ongoing puzzle.

- Data Management and Reporting: Modern compliance relies on quality data – for KYC, transaction monitoring, trade reporting, etc. Many firms grapple with legacy systems and data silos that make it hard to get a single customer view or to aggregate risk data accurately. According to industry surveys, a large portion of compliance effort is still spent manually gathering and reconciling data. Errors in regulatory reporting or data leaks can bring penalties or reputational damage.

- Technology and Cyber Risks: Ironically, while technology is part of the solution, it’s also a risk. Implementing big compliance IT projects (like an AML system overhaul or a new regulatory reporting tool) can be complex and occasionally disruptive if done wrong. Additionally, financial institutions are huge targets for cyberattacks – a successful breach can not only harm customers but also put the firm in violation of data protection laws or operational resilience requirements. Ensuring continuous uptime and security is now a compliance expectation (e.g. regulators might fault a bank if a preventable IT outage harms customers).

- Cultural and Ethical Issues: Compliance isn’t just about rules, it’s about behavior. Some institutions have struggled with a culture that tolerates bending rules for profit. Scandals like the LIBOR manipulation and various mis-selling incidents often pointed to cultural failures. Embedding a culture of integrity and accountability remains a challenge – it requires tone-from-the-top and constant reinforcement. Employees may experience “compliance fatigue” given the sheer number of rules, so keeping them engaged and vigilant is hard.

- Global vs. Local Coordination: In large multinational firms, the central compliance function must set standards, but local teams must tailor to national laws. Sometimes business lines operate in silos, leading to inconsistent compliance. Achieving group-wide standards (for example, one global AML policy that meets the highest common denominator) means overcoming internal differences and legacy local practices. Misalignment can result in gaps that regulators will find (e.g. one country unit failing to implement a group compliance policy properly).

- Regulator Expectations and Enforcement Pressure: Regulators worldwide have become more assertive, expecting not just formal compliance but effective compliance outcomes (e.g. actual reduction in money laundering flows, not just box-ticking). They also increasingly share information and coordinate cross-border. This means a misstep in one jurisdiction can trigger inquiries elsewhere. The personal liability trend also weighs on senior management, increasing the stakes. Institutions sometimes feel regulators lack appreciation of practical challenges, yet they must comply regardless.

Best Practices for Effective Compliance

Despite the challenges, many financial institutions have significantly strengthened their compliance risk management. Here are best practices that exemplify an effective compliance program:

- 1. Strong “Tone at the Top” and Governance: Senior leadership and the Board should demonstrably support compliance. This includes establishing a compliance committee at the board level, regularly reviewing compliance metrics, and holding management accountable for compliance results. A clear compliance charter defining its independence and authority, with direct reporting lines for the Chief Compliance Officer (CCO) to the CEO or Board, helps ensure compliance has clout. An example of good practice is linking a portion of executive compensation to compliance KPIs or risk management outcomes, reinforcing that compliance is a shared responsibility, not just the compliance department’s job.

- 2. Risk-Based Approach: Given infinite tasks and finite resources, prioritization is key. Effective programs use enterprise-wide compliance risk assessments to identify areas of highest risk (e.g. products or geographies with higher money laundering risk, business units with complex conflict of interest scenarios, etc.). They then allocate compliance resources accordingly and tailor controls to the level of risk. Regulators explicitly endorse this approach – for instance, AML laws require a risk-based approach and expect enhanced measures for higher risks. By focusing efforts where potential impact is greatest, institutions manage regulatory expectations and internal costs better.

- 3. Comprehensive Policies and Procedures (Regularly Updated): Firms maintain a library of compliance policies (AML manual, code of ethics, trading compliance policy, data privacy policy, etc.). Leading firms ensure these documents are living – updated promptly for new laws or regulator guidance – and practical, not just legalese. They often accompany policies with procedure manuals, checklists, and automated workflows that guide employees through compliant execution (for example, a checklist for onboarding a high-risk customer that covers all enhanced due diligence steps). Version control and staff attestation (where employees periodically attest they’ve read and understood key policies) are also common.

- 4. Training and Awareness: Ongoing training is critical to embed compliance in day-to-day operations. Effective programs use a mix of computer-based training for general topics (e.g. annual AML and privacy training for all staff) and targeted, in-depth training for specific roles (e.g. an in-person workshop for traders on market abuse scenarios, or scenario-based training for relationship managers on identifying suspicious client behavior). To combat “training fatigue,” some companies use interactive methods or gamification to keep it engaging. Case studies of real incidents and lessons learned can be particularly impactful, making abstract rules concrete. A culture where employees feel comfortable asking compliance for advice is also a sign of good awareness.

- 5. Monitoring, Testing, and Audit: Trust but verify. Compliance departments set up monitoring routines – automated systems for transactional monitoring (AML, fraud), surveillance of communications (to detect potential market abuse or misconduct), and reviews of samples of transactions or files for quality control. They also conduct periodic compliance testing or reviews (sometimes called second-line testing or quality assurance) to assess if controls are working as intended. For example, compliance might test a sample of mortgage files to see if all required disclosures were given to customers. In addition, the internal audit function (third line of defense) should independently audit the compliance program itself regularly. Strong programs ensure findings from monitoring and audits are tracked and remediated promptly, with root cause analysis to prevent recurrences.

- 6. Use of Technology and Data Analytics: With the scale of data involved in compliance, technology is an indispensable aid. Leading institutions invest in RegTech solutions: AI-driven tools to flag anomalous transactions, machine learning models that adapt to new financial crime patterns, natural language processing to scan communications for compliance risks, etc. They also build integrated data lakes for compliance, so that, for instance, KYC information, transaction records, and case investigation notes can be linked and analyzed together. Data analytics can help identify trends (e.g. upticks in certain fraud types) and allow more real-time compliance rather than after-the-fact detection. However, institutions also validate and govern these tools (to ensure, for example, that an AI model’s decisions can be explained to regulators to avoid the “black box” issue). Even mid-sized firms are now leveraging cloud-based compliance software for things like regulatory change tracking or e-learning management, which increases efficiency.

- 7. Effective Issue Management and Escalation: No system is foolproof – when issues arise (like a compliance breach or an exam finding), best practice is to address them openly and decisively. Firms often have an issue management system where compliance issues are logged, investigated, and remediated with clear ownership. Escalation protocols ensure that serious matters (e.g. a significant trade error affecting clients, or a potential internal fraud case) are quickly brought to the attention of senior management and, where required, regulators. Regulators appreciate prompt self-reporting of problems coupled with credible remediation plans – this can significantly mitigate enforcement action. A culture where employees can report concerns (through hotlines or whistleblower programs) without fear is also vital; many compliance scandals were exposed by insiders speaking up.

- 8. Continuous Engagement with Regulators: The best compliance functions maintain an open, proactive dialogue with their regulators. This might involve periodic calls or meetings to update on compliance enhancements, seeking feedback or interpretations on unclear rules, and involvement in industry associations that discuss regulatory issues. By building trust, institutions can sometimes gain insights into regulatory priorities (for example, knowing that the regulator will focus on climate risk next year allows advance preparation). During regulatory exams, having organised documentation, knowledgeable staff presentations, and a cooperative attitude goes a long way. In case of identified shortcomings, showing a credible commitment to fix them through proper action plans can often prevent escalation.

- 9. Documentation and Evidence: In compliance, it’s often said “if it’s not documented, it didn’t happen.” Regulators expect to see evidence of compliance activities – whether it’s logs of monitoring alerts and their resolution, minutes of risk committee meetings discussing compliance issues, or model validation reports for risk models. Top-tier programs have thorough documentation practices. This not only helps in exams but also in internal knowledge management (new compliance staff can understand the history and rationale of decisions). For instance, decisions to risk-rate a certain country high or low for AML should be documented in the firm’s risk assessment with supporting rationale (like referencing FATF evaluations). Good documentation also extends to keeping audit trails of who reviewed and approved what, to enforce accountability.

- 10. Ethical Decision-Making Framework: Regulations can’t cover every scenario, so firms emphasize an ethical framework for decision-making. This might be encapsulated in a Code of Conduct that goes beyond legal minimums (e.g. committing to fairness, transparency, and responsibility as core values). When novel situations arise (like dealing with an ambiguous crypto product, or navigating business in a country with weak governance), employees are encouraged to ask, “Is this consistent with our values and principles?” Some firms have ethics committees or require a “New Product Committee” review that includes compliance, legal, risk, and sometimes an ethics representative, to vet innovative proposals. By instilling an ethics mindset, firms can avoid the trap of doing something technically legal but reputationally damaging.

Implementing these best practices helps create a compliance culture – where doing the right thing is part of business as usual. It’s noteworthy that regulators themselves often evaluate the effectiveness of a compliance function by looking at these elements. For example, the U.S. Department of Justice and others have issued guidance on evaluating corporate compliance programs, highlighting many of the points above (risk-based approach, senior support, continuous improvement, etc.). Similarly, in Europe, ESMA’s and EBA’s guidelines explicitly call for sufficient compliance resources, independence, and direct access to management.

In practice, achieving excellence in compliance is a journey. Institutions may start by remediating past issues, then gradually moving to a more proactive stance using advanced analytics and fostering a compliance-as-a-core-value environment. Peer learning is valuable – many banks collaborate in information-sharing forums for threats like fraud/AML (within legal limits) and to develop best practice standards (for instance, the Wolfsberg Group principles for private banking AML). The ultimate goal is a state where compliance is not seen as a cost center or obstacle, but as an integral part of the institution’s business strategy and risk management, safeguarding its long-term sustainability and reputation.

Reduce your

compliance risks